What is Cryptocurrency? A Beginner’s Guide in 2025

Hey, have you ever wondered how money works in the digital world? Like, you use UPI to send ₹500 to a friend instantly, but behind it, there’s a bank checking everything. Now, imagine sending money without any bank, no waiting, and no one in the middle controlling it. That’s the magic of cryptocurrency. If you’re new to this and have never heard of it before, don’t worry this guide is for you. We’ll explain everything in simple words, like chatting over chai. By the end, you’ll know what crypto is, how it works, why people use it, the risks, and if it’s something you should look into in 2025. Let’s get started!

1. What is Cryptocurrency?

Cryptocurrency, or “crypto” for short, is basically digital money. It’s not like the notes in your wallet or the balance in your bank app. Instead, it’s created and stored using special computer technology called blockchain.

- Simple Definition: Think of crypto as online cash that you can send to anyone in the world without needing a bank. It’s secure because it’s protected by math and codes, not by a government or company.

- Why “Crypto”: The word comes from “cryptography,” which means secret codes that keep it safe from hackers.

- Real-Life Analogy: Imagine a notebook where every money transfer is written down, and copies of that notebook are shared with millions of people. If someone tries to cheat, everyone can see it. That’s crypto no single person controls it.

- Fun Fact for Beginners: The first crypto was Bitcoin, invented in 2009 by someone (or a group) called Satoshi Nakamoto. No one knows who they are, even today!

In India, crypto is getting popular, but it’s not like regular money. You can buy it, sell it, or use it for payments, but the government treats it like an investment with taxes.

2. How Does Cryptocurrency Work?

Crypto isn’t magic it’s tech! Here’s a step-by-step explanation so you can picture it easily.

- The Blockchain Basics: Blockchain is like a chain of blocks (digital pages) that record every transaction. Each block has details like “A sent 1 Bitcoin to B at this time.” Once written, it can’t be changed it’s locked forever.

- No Banks Needed: When you send crypto, computers around the world (called “nodes”) check and add it to the blockchain. This makes it “decentralized” no one boss controls it.

- Mining or Creating Crypto: New crypto is “mined” by computers solving hard puzzles. It’s like digging for gold, but with math. For example, Bitcoin is mined this way.

- Wallets and Keys: You store crypto in a “wallet” app on your phone or computer. It’s protected by private keys (like a super-secret password). Lose the key? Lose your crypto!

- Sending Money: To send ₹1,000 worth of Bitcoin to a friend in the US, you use their wallet address. It takes minutes, costs pennies, and no bank fees or waiting for holidays.

- India Example: If the rupee weakens (like it did in 2024), you could buy USD-based stablecoins (a type of crypto) to protect your savings. But remember, prices can change fast!

Crypto works 24/7, unlike banks that close at 5 PM. That’s why it’s great for global payments.

3. Popular Cryptocurrencies in 2025

There are thousands of cryptos, but let’s focus on the big ones beginners should know. Prices change daily, so these are approximate as of September 17, 2025.

- Bitcoin (BTC): The “king” of crypto. It’s like digital gold people buy it to store value. Price: around ₹10,213,151 per Bitcoin. If you buy a tiny fraction (like ₹1,000 worth), that’s fine!

- Ethereum (ETH): More than money it’s a platform for apps and smart contracts (automatic agreements). Price: about ₹395,180 per ETH. It’s used for things like online games or loans.

- Stablecoins (e.g., USDT, USDC): These are tied to real money like the US dollar, so their price stays stable (around ₹83, like USD/INR). Great for sending money without wild swings.

- Altcoins (Alternatives): Other coins like Solana (SOL) for fast transactions or Dogecoin (DOGE) for fun memes. They’re riskier but can grow fast.

In India, people often start with Bitcoin or Ethereum on apps like CoinDCX, as they’re easier to understand.

4. Why Do People Use Cryptocurrency?

Crypto isn’t just for tech geeks it’s useful in everyday life. Here’s why it’s popular in 2025:

- Fast and Cheap Global Payments: Send ₹10,000 to a relative in the US in minutes for a small fee, no bank holidays or high charges.

- No Middlemen: No bank can freeze your money or ask why you’re sending it. It’s your control.

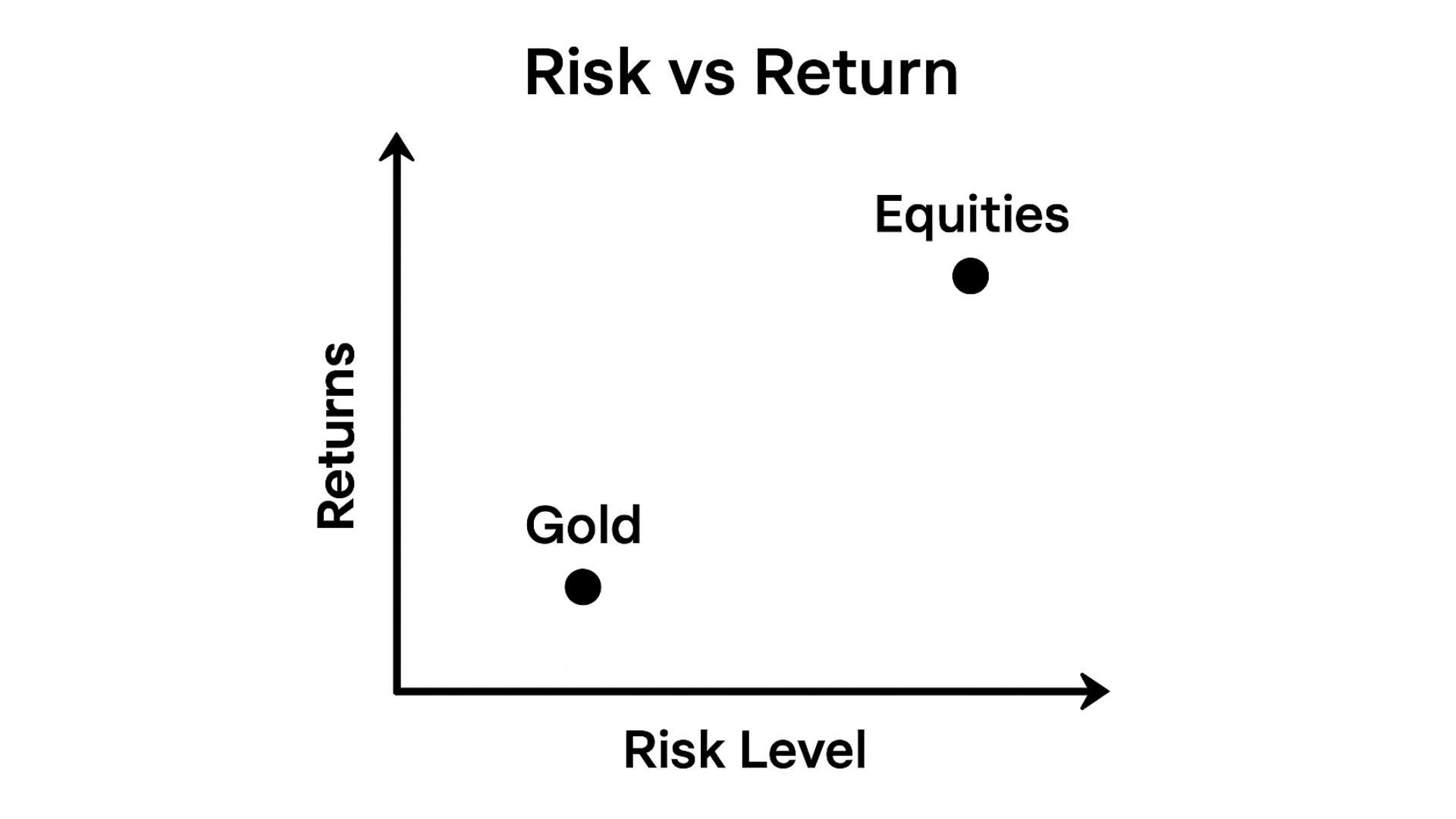

- Investment Opportunity: Prices can go up a lot. For example, Bitcoin grew from ₹5 lakh in 2020 to over ₹10 million in 2025!

- Privacy: Transactions are public on blockchain, but your name isn’t attached it’s like a code.

- India Angle: With our economy growing at 6.2%, many use crypto to hedge against rupee changes or send money abroad cheaply.

- New Uses: Buy NFTs (digital art) or play games where you earn crypto.

But remember, it’s not for daily shopping yet in India most stores don’t accept it.

5. The Risks You Need to Know

Crypto sounds cool, but it’s not all rainbows. Here’s what beginners must understand:

- Price Swings (Volatility): Prices can drop 20% in a day. Imagine buying something for ₹1,000 and it becoming ₹500 tomorrow.

- Scams and Hacks: Fake apps or “rug pulls” where creators run off with money. Always check if it’s legit.

- No Safety Net: Unlike banks (protected by RBI), crypto has no insurance if you lose your key or get hacked.

- Taxes in India: You pay 30% tax on profits and 1% TDS on transactions treat it like an investment, not free money.

- Government Rules: In India, crypto isn’t banned, but it’s not fully regulated yet. RBI is testing digital rupee (CBDC) to compete with it.

- Crunchy Tip: Only use money you can afford to lose, like extra savings after your emergency fund.

6. How to Start with Cryptocurrency Safely in 2025

Don’t rush start slow. Here’s a step-by-step guide for beginners in India:

- Learn More: Read simple books or watch YouTube videos. Start with “What is Blockchain?” it’s the backbone of crypto.

- Choose a Safe App: Use trusted exchanges like CoinDCX, WazirX, or Binance India. They follow KYC rules (like Aadhaar verification).

- Buy a Little: Start with ₹500–1,000. Buy Bitcoin or Ethereum using UPI or bank transfer.

- Store Securely: Use the app’s wallet or a hardware wallet (like Ledger) for safety.

- Track Taxes: Report profits in your ITR 30% tax + 1% TDS.

- Stay Safe: Never share your private key. Use 2-factor authentication. Avoid “get rich quick” schemes.

- India Example: Raj from Mumbai buys ₹1,000 Bitcoin on CoinDCX. If it grows 10%, he makes ₹100—but pays tax if he sells.

7. The Future of Cryptocurrency in 2025 and Beyond

Crypto is evolving fast. Here’s what to watch in 2025:

- More Rules: India is resisting full crypto laws but fears risks. RBI is testing digital rupee (CBDC) to make payments faster and safer.

- Growing Adoption: Chainalysis ranks India high in crypto adoption. More companies accept crypto for payments or investments.

- New Trends: Stablecoins for steady value, NFTs for digital art, DeFi for loans without banks.

- India’s Role: With 6.2% GDP growth, crypto could help remittances (₹8 lakh crore annually, RBI 2024).

- Risks Ahead: Governments might add more taxes or restrictions.

Crypto might become as common as UPI one day, but it’s still new—so learn before leaping.

8. Frequently Asked Questions (FAQ)

- What is cryptocurrency?

Digital money using blockchain, like Bitcoin, without banks. - Is crypto legal in India?

Yes, but taxed at 30% on profits and 1% TDS no full regulation yet. - How much to start with crypto?

₹500–1,000 on apps like WazirX start small. - Is crypto safe?

No, high risks from scams and price drops only invest what you can lose. - What’s the best crypto for beginners in 2025?

Bitcoin or Ethereum avoid unknown coins.

9. Conclusion

Cryptocurrency is an exciting new way to think about money digital, fast, and global. But it’s not for everyone, especially beginners. In 2025, with India’s growing economy and more people using apps like WazirX, it’s worth learning about. Just remember the risks: prices can crash, and scams are common. Start small, use trusted apps, and always learn more. At CrunchyFin, we say: Crypto is a tool, not a treasure hunt. Use it wisely, and it could be part of your financial plan, alongside things like health insurance (post). Happy exploring!

Disclaimer: Crypto involves high risks; prices can fall, and 50% of traders lose money (CoinGecko, 2024). Consult an advisor; this is not financial advice.