What is an IPO? How Companies Go Public and Investors Benefit

Have you ever heard the buzz around a new stock launching and wondered what exactly is an Initial Public Offering (IPO), and how can I get in on the action?

An IPO is a company’s “grand debut” on the public stock market stage. It’s the moment a previously private company decides to sell its shares to the general public for the very first time.

Simply put, an IPO is your first opportunity to become a part-owner of a rapidly growing company.

But why do companies go public, and how can you, as an Indian investor, profit (or lose) from these high-stakes debuts? Let’s break down the IPO meaning, process, and smart investment strategy step-by-step.

Understanding the Core: What is an IPO?

IPO is an abbreviation for Initial Public Offering.

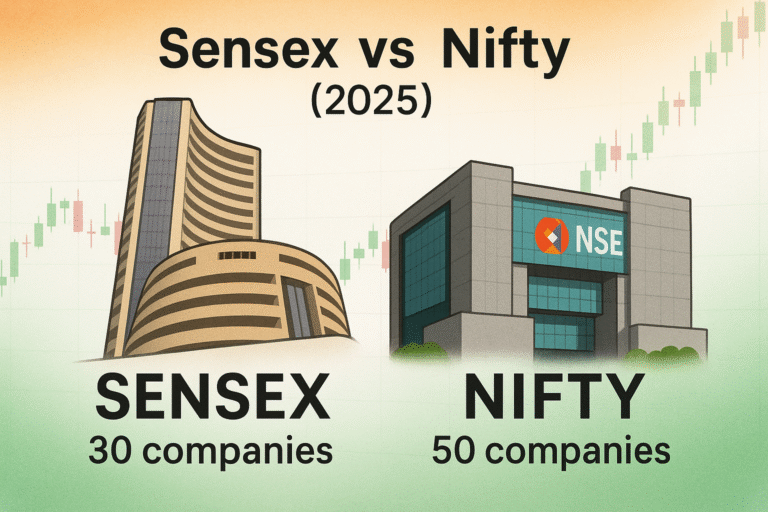

| Before an IPO | After an IPO |

| Ownership is limited to founders, employees, and early private investors (like Venture Capitalists). | Ownership is opened up to the general public, including everyday retail investors like you. |

| The company is privately held. | The company is publicly listed on a stock exchange (like the NSE or BSE in India). |

Why Do Companies Launch an Initial Public Offering?

Going public is a massive undertaking, not a spur-of-the-moment decision. Companies launch an IPO primarily to facilitate aggressive growth and provide liquidity.

1. Raise Capital for Expansion (The Primary Goal)

The most crucial reason is to raise large amounts of capital. Companies use this new funding to:

- Fuel aggressive expansion and market penetration.

- Develop and launch new products or services.

- Pay off existing debt, strengthening their balance sheet.

2. Increased Brand Visibility and Trust

Being listed on a major stock exchange significantly boosts a company’s profile. Public listing:

- Enhances the company’s credibility and public trust.

- Makes it easier to attract top talent and secure future loans.

3. Providing an “Exit” for Early Investors

Venture capitalists and early private backers need a way to cash out and book their profits. The IPO provides the perfect opportunity for them to sell their shares to the public and realize their investment returns.

4. Employee Motivation

Many high-growth companies offer Employee Stock Options (ESOPs). After an IPO, these stocks become tradeable and valuable, serving as a powerful tool to motivate and retain talent.

How Does an IPO Work in India? (The Step-by-Step Process)

The process is highly regulated, ensuring fairness and transparency, especially by the Securities and Exchange Board of India (SEBI).

- Hiring Investment Bankers: The company selects lead managers who help decide the number of shares to sell and the appropriate price band.

- SEBI Filing & Approval: The company files its Draft Red Herring Prospectus (DRHP) with SEBI, which thoroughly scrutinizes the documents to protect investor interest.

- The Roadshow: Company leaders present their business and growth story to major institutional investors, drumming up demand.

- Pricing: Shares are typically offered through a book-building process, where a price band is set, and the final cut-off price is determined by investor demand.

- Application and Allotment: Retail investors apply through their broker (like Zerodha, Groww, or Upstox). If demand is higher than the available supply (oversubscription), shares are allotted via a transparent lottery system.

- Listing Day: This is the big day! The company’s shares are finally listed on the NSE/BSE, and trading officially begins.

The Investor’s Playbook: How to Benefit from IPO Investing

IPO investing can be a thrilling wealth-creation strategy, but it requires research. Here are the main ways investors gain:

| Listing Gains | Long-Term Capital Growth |

| When the stock’s opening price on the listing day is significantly higher than the issue price (often leading to quick, high profits). | If the underlying company continues to perform well, your investment grows with its profitability over years or decades. |

| Ownership in Big Brands | Potential for Multibagger Returns |

| You get to own a piece of brands you use every day, such as a major tech company or a leading retailer. | History is filled with companies (like Infosys or TCS) that were once IPOs and have delivered life-changing returns. |

Critical Risks of IPOs (What You Must Know)

As exciting as it is, IPO investing comes with higher risks. Don’t invest blindly.

| Listing Failures | Overpricing due to Hype |

| Not all IPOs succeed. If the market sentiment is poor or the company is weak, the stock can list below the issue price, resulting in immediate losses. | High investor hype and frenzy often lead to the company being priced higher than its true value. |

| Lack of History | Market Volatility |

| Unlike established public companies, IPOs lack a long history of quarterly results as a public entity, making financial analysis challenging. | The stock is highly sensitive to general market movements, especially in the first few months after listing. |

Final Thoughts: Invest Smart, Not Blindly

An IPO is more than just a stock launch it’s a company’s invitation for you to become a partner in its growth story.

For a smart human-first investment strategy:

- Do Your Homework: Always study the company’s financials (revenue, profit, debt), business model, and valuation against its peers.

- Don’t Get Carried Away: Never let market hype dictate your investment decision. Invest only what you are comfortable losing.

Ready to explore your next IPO opportunity? Research before you invest!