What Are Bonds? Types, Benefits, and Risks Explained for Indian Investors in 2025

Imagine lending ₹10,000 to a friend who promises to pay you back with 7% interest every year. That’s the essence of bonds a safe, steady way to grow your money by lending to governments or companies. In India, with rising interest rates and over 20 crore demat accounts fueling investing in India, bonds are a cornerstone of personal finance in 2025. Whether you’re saving for a house, funding health insurance premiums, or balancing a stock-heavy portfolio, this guide explains what bonds are, their types, benefits, and risks in simple terms. Backed by insights from SEBI, RBI, and global studies, we’ll show you how bonds can secure your financial future.

1. What Are Bonds?

A bond is a loan you give to a government, company, or institution in exchange for regular interest payments (called coupons) and your principal back when the bond matures. Think of it as a financial IOU where you’re the lender, and the issuer is the borrower.

1.1 How Bonds Work

- Process: You buy a bond (e.g., ₹10,000 RBI bond at 7.1% interest). The issuer pays you interest annually or semi-annually, and returns your ₹10,000 at maturity (e.g., 7 years).

- Fixed-Income: Bonds are called fixed-income securities because they provide predictable returns.

- Example: Invest ₹1 lakh in a 7% corporate bond; earn ₹7,000/year plus your ₹1 lakh back.

1.2 Why Bonds Matter in India 2025

- Economic Role: Bonds fund India’s infrastructure and startups, supporting 7.8% GDP growth (RBI, Q1 FY26).

- Investor Appeal: With Sensex volatility (3% drop in July 2025), bonds offer stability.

- Personal Finance: Bond returns can cover essentials like health insurance (see our guide) or supplement your budget planner.

- Market Size: India’s bond market is ₹47 lakh crore (2025), per RBI data.

2. Types of Bonds Available in India

Bonds come in various forms, each suited to different goals and risk levels. Here are the key types for Indian investors:

2.1 Government Bonds (G-Secs)

- What: Issued by the RBI for the Government of India.

- Features: Very safe; backed by government; yields 6.5–7.5% (2025).

- Example: 7.1% RBI Bond 2034; invest ₹10,000, get ₹710/year.

- Best for: Risk-averse investors, retirees.

- Availability: Via RBI Retail Direct or brokers like Zerodha.

2.2 Corporate Bonds

- What: Issued by companies like Tata or Reliance.

- Features: Higher yields (7–9%); risk depends on company credit rating (e.g., AAA safer than BBB).

- Example: ₹1 lakh in a 8% Tata Capital bond yields ₹8,000/year.

- Best for: Moderate-risk investors seeking higher returns.

2.3 Tax-Free Bonds

- What: Issued by PSUs like NHAI, IRFC; interest exempt from tax.

- Features: Yields 5–6%; tax-free status boosts effective returns.

- Example: ₹1 lakh in NHAI 5.75% tax-free bond saves ~₹1,500 in taxes for 30% tax bracket.

- Best for: High-income earners in India.

2.4 Zero-Coupon Bonds

- What: Sold at a discount, no periodic interest; redeemed at face value.

- Features: Profit from price difference; e.g., buy at ₹7,000, redeem at ₹10,000.

- Example: SIDBI zero-coupon bond; ideal for long-term goals.

- Best for: Investors planning for future expenses (e.g., education).

2.5 Convertible Bonds

- What: Can convert into company shares at a set price.

- Features: Mix of bond safety and stock upside; moderate risk.

- Example: ICICI Bank convertible bond; convert to shares if stock rises 20%.

- Best for: Investors wanting equity exposure with protection.

2.6 High-Yield (Junk) Bonds

- What: Issued by lower-rated companies; high interest (10–12%).

- Features: High risk of default; not common in India.

- Example: Rare in India; more prevalent in global markets.

- Best for: High-risk investors (avoid for beginners).

3. Benefits of Investing in Bonds

Bonds are a staple in personal finance for their stability and predictability. Here’s why they shine:

3.1 Stable Income

- Regular interest payments (e.g., ₹7,100/year on a ₹1 lakh RBI bond).

- Ideal for retirees or those needing cash flow.

3.2 Diversification

- Balances risk in a stock-heavy portfolio (stocks dropped 3% in July 2025, bonds stayed stable).

- OECD studies highlight bonds as key to portfolio stability.

3.3 Capital Preservation

- Government bonds (G-Secs) ensure principal safety.

- SEBI data: Zero defaults on G-Secs in past decade.

3.4 Predictability

- Fixed returns aid planning (e.g., fund health insurance premiums).

- Use our budget planner to allocate bond income.

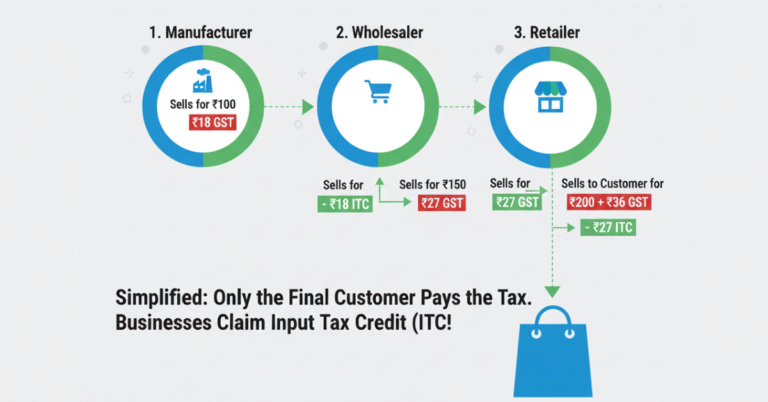

3.5 Tax Benefits

- Tax-free bonds save ₹1,500–₹3,000 annually for high earners.

- Section 80C deductions for specific bonds (e.g., PFC bonds).

4. Risks of Investing in Bonds

While safer than stocks, bonds aren’t risk-free. Here are the key risks:

4.1 Interest Rate Risk

- Issue: Rising rates lower bond prices (e.g., RBI repo rate 6.5% in 2025).

- Example: A 7% bond loses value if new bonds offer 8%.

- Mitigation: Choose shorter-maturity bonds (3–5 years).

4.2 Credit Risk

- Issue: Issuer may default (rare for G-Secs, higher for corporate bonds).

- Example: IL&FS default (2018) hit bondholders.

- Mitigation: Stick to AAA-rated bonds or G-Secs.

4.3 Inflation Risk

- Issue: Inflation (4.5% in 2025) erodes fixed returns.

- Example: A 6% bond yields less real return if inflation rises.

- Mitigation: Invest in inflation-linked bonds (e.g., RBI IINSS-C).

4.4 Liquidity Risk

- Issue: Some bonds (e.g., PSU bonds) are hard to sell.

- Mitigation: Buy bonds traded on NSE/BSE or via RBI Retail Direct.

5. Bonds vs. Stocks: A Quick Comparison

| Feature | Bonds | Stocks |

|---|---|---|

| Risk Level | Low to Moderate | High |

| Returns | Fixed, 6–9% (India) | Variable, 10–20% potential |

| Ownership | Lender (creditor) | Partial owner |

| Volatility | Low | High |

| Best for | Stability, income | Growth, risk-takers |

Insight: Per Yale’s behavioral finance studies, investors often over-rely on stocks for growth, but bonds reduce portfolio volatility by 20–30%.

6. Who Should Invest in Bonds?

Bonds suit a range of Indian investors:

- Retirees: Seek stable income (e.g., G-Secs for pensioners).

- Conservative Investors: Prefer safety over high returns.

- Portfolio Balancers: Offset stock risks (see our stock market guide).

- Goal-Oriented: Fund medium-term goals like education or health insurance.

7. Bonds in India 2025: Trends and Opportunities

- Rising Yields: RBI’s 6.5% repo rate makes bonds attractive (G-Secs at 7–7.5%).

- Green Bonds: ₹50,000 crore issued in 2024 for sustainable projects (RBI data).

- Digital Access: RBI Retail Direct and apps like Zerodha simplify bond buying.

- Global Context: OECD notes bonds gaining traction as rates rise globally (3–4% in US, 2025).

8. How to Start Investing in Bonds in India

Ready to add bonds to your personal finance plan? Follow these steps:

8.1 Set Goals

- Short-term: Emergency fund (1–3 years).

- Long-term: Retirement, health insurance premiums (₹10,000–20,000/year).

8.2 Choose Bond Type

- Beginners: G-Secs or tax-free bonds (low risk).

- Moderate risk: AAA-rated corporate bonds.

8.3 Open an Account

- Platforms: RBI Retail Direct (free), Zerodha, ICICI Direct.

- Process: KYC with PAN, Aadhaar; 10 minutes.

8.4 Research Bonds

- Tools: RBI website, Bondbazaar, Moneycontrol.

- Metrics: Yield to maturity (YTM), credit rating (AAA best).

- Example: 7.1% RBI Bond 2034; YTM ~7.2%.

8.5 Invest and Monitor

- Minimum: ₹1,000 (RBI bonds).

- Monitor: Check interest payments; sell if rates rise significantly.

9. Frequently Asked Questions (FAQ)

9.1 What are bonds?

Bonds are loans to governments/companies, paying fixed interest and returning principal at maturity.

9.2 Are bonds safe for Indian investors?

Yes, especially G-Secs; corporate bonds carry credit risk (check AAA ratings).

9.3 How do bonds fit into personal finance?

Provide stable income for goals like health insurance or retirement; diversify portfolios.

9.4 Where can I buy bonds in India?

Use RBI Retail Direct, Zerodha, or NSE’s bond platform.

9.5 What’s the best bond for 2025?

G-Secs (7–7.5% yield) for safety; tax-free bonds for high earners.

10. Conclusion

Bonds are your financial safety net in 2025, offering stability in a volatile world. With India’s bond market at ₹47 lakh crore and yields rising, they’re a smart choice for investing in India. Whether you’re funding health insurance, balancing stocks, or planning retirement, bonds provide predictable income and capital protection. Start small with a ₹1,000 RBI bond, diversify your portfolio, and use our budget planner to stay on track. Take control of your personal finance today!