What Is the Money Market? Explained with Simple Examples for Indian Investors in 2025

When you hear “markets,” you might picture the stock market’s rollercoaster or crypto’s wild swings. But there’s a quieter, steady player in India’s financial system: the money market. It’s like the reliable auto-rickshaw that keeps banks, companies, and governments moving smoothly every day. In 2025, with India’s bond market at ₹47 lakh crore (RBI) and 20 crore demat accounts (SEBI), the money market is a safe, smart option for investing in India. Whether you’re parking ₹10,000 for a short-term goal like health insurance premiums or learning how banks manage cash, this guide simplifies the money market, its tools, benefits, and risks. Packed with real examples and practical tips, it’s your roadmap to understanding this financial backbone in 2025!

1. What Is the Money Market?

The money market is where big players borrow and lend money for short periods—usually less than a year—to manage cash flow.

- Timeframe: 1 day to 12 months.

- Players: Banks (e.g., SBI, HDFC), governments, corporations (e.g., Reliance).

- Purpose: Ensure liquidity (ready cash) for daily operations.

- Analogy: Think of lending ₹500 to a friend until payday, but on a massive scale—banks lending crores overnight!

- India Context: Regulated by RBI; ₹15 lakh crore daily turnover (2025, RBI data).

Why It Matters: The money market keeps India’s economy stable, funds government projects, and offers safe investment options for you.

2. Why the Money Market Is Crucial in India

The money market is the unsung hero of personal finance and economic stability. Here’s why:

- Stabilizes Economy: Ensures banks/companies have cash to operate, preventing financial hiccups.

- Funds Governments: RBI uses T-Bills to borrow for short-term needs (e.g., budget deficits).

- Safe Investments: Offers low-risk options like money market funds for retail investors.

- Supports Goals: Park funds for short-term needs like health insurance (see our guide) or a vacation.

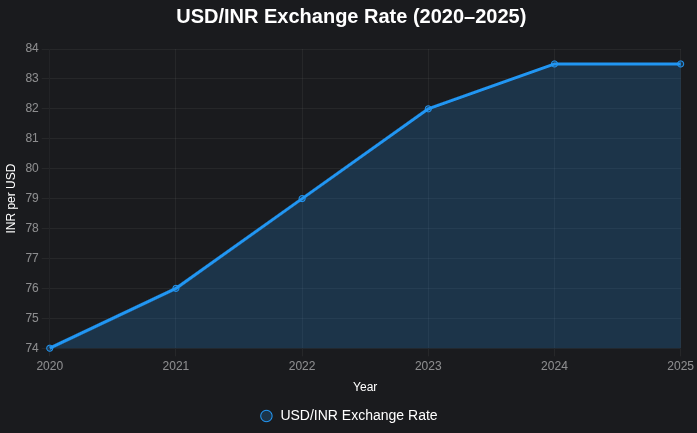

- 2025 Impact: With RBI’s 6.5% repo rate, money market yields (5–7%) beat savings accounts (3–4%).

Example: When RBI issued ₹1.2 lakh crore in T-Bills in Q1 2025, it funded infrastructure without hiking taxes.

3. Key Money Market Instruments in India

The money market uses specific tools for borrowing and lending. Here are the main ones:

- 3.1 Treasury Bills (T-Bills)

- Issued by: Government of India via RBI.

- Tenure: 91, 182, or 364 days.

- Risk: Near-zero (government-backed).

- How It Works: Buy at a discount (e.g., ₹95 for ₹100 face value); get ₹100 at maturity.

- Yield: 5–6.5% annualized (2025, RBI).

- Example: Invest ₹1 lakh in a 91-day T-Bill at 5.5%; earn ₹1,375 in 3 months.

- 3.2 Certificates of Deposit (CDs)

- Issued by: Banks like HDFC, ICICI.

- Tenure: 7 days to 1 year.

- Risk: Low (bank-backed, insured up to ₹5 lakh by DICGC).

- Yield: 5.5–7% (2025).

- Example: ₹1 lakh in a 6-month SBI CD at 6% yields ₹3,000.

- 3.3 Commercial Papers (CPs)

- Issued by: Corporates like Reliance, Tata.

- Tenure: 15 days to 1 year.

- Risk: Moderate (depends on company rating, e.g., AAA safer).

- Yield: 6–8%.

- Example: ₹1 lakh in a 180-day Reliance CP at 7% yields ₹3,500.

- 3.4 Call Money Market

- What: Overnight loans between banks.

- Tenure: 1–14 days.

- Risk: Low (interbank, RBI-regulated).

- Example: SBI borrows ₹1,000 crore from HDFC overnight at 6.25%.

- 3.5 Repurchase Agreements (Repos)

- What: Short-term loans backed by securities (e.g., G-Secs).

- Tenure: 1–14 days.

- Rate: Linked to RBI repo rate (6.5%, 2025).

- Example: Bank borrows ₹500 crore, pledging T-Bills as collateral.

4. How Can Indian Investors Access the Money Market?

The money market was once for big players, but retail investors like you can now join in:

- Money Market Mutual Funds (MMMFs)

- Invest in T-Bills, CDs, CPs.

- Example: HDFC Money Market Fund (6.8% annualized, 2025).

- Minimum: ₹100 via SIPs on Groww.

- Debt Mutual Funds

- Focus on short-term instruments .

- Example: ICICI Pru Ultra Short Term Fund (6–7% returns).

- Best for: Low-risk, short-term goals.

- Direct Investments

- Buy T-Bills via RBI Retail Direct or brokers like Zerodha.

- CDs available through banks (e.g., SBI, HDFC).

- Minimum: ₹10,000 (T-Bills).

Pro Tip: Use apps like Zerodha or Groww for easy access; check RBI Retail Direct for T-Bills.

5. Benefits of Money Market Investments

Money market instruments are a safe bet for short-term savings:

- High Safety

- T-Bills: Zero defaults (RBI-backed).

- CDs: Insured up to ₹5 lakh (DICGC).

- Morningstar: Money market funds among safest debt options.

- Great Liquidity

- Sell MMMFs in 1–3 days; T-Bills trade on NSE.

- Ideal for emergencies or quick cash needs.

- Better Returns

- 5–7% vs. 3–4% savings accounts (2025).

- Example: ₹50,000 in a 6-month T-Bill at 5.5% = ₹1,375 vs. ₹750 in savings.

- Short-Term Goals

- Perfect for saving for health insurance premiums (₹10,000–20,000/year) or a wedding in 6 months.

- Use our budget planner to plan.

6. Risks to Understand

Even safe investments have risks:

- Lower Returns

- 5–7% vs. stocks’ 12–20% (see our stock market post).

- Fix: Use for short-term, not long-term, wealth.

- Inflation Risk

- Inflation (4.5%, 2025) may outpace returns (e.g., 5% T-Bill).

- Fix: Pair with equity funds for long-term goals (see mutual funds post).

- Credit Risk (CPs)

- Corporates may default (e.g., IL&FS, 2018).

- Fix: Stick to AAA-rated CPs or T-Bills.

- Interest Rate Risk

- Rising RBI rates (6.5%) lower existing bond prices.

- Fix: Choose short tenures (91 days).

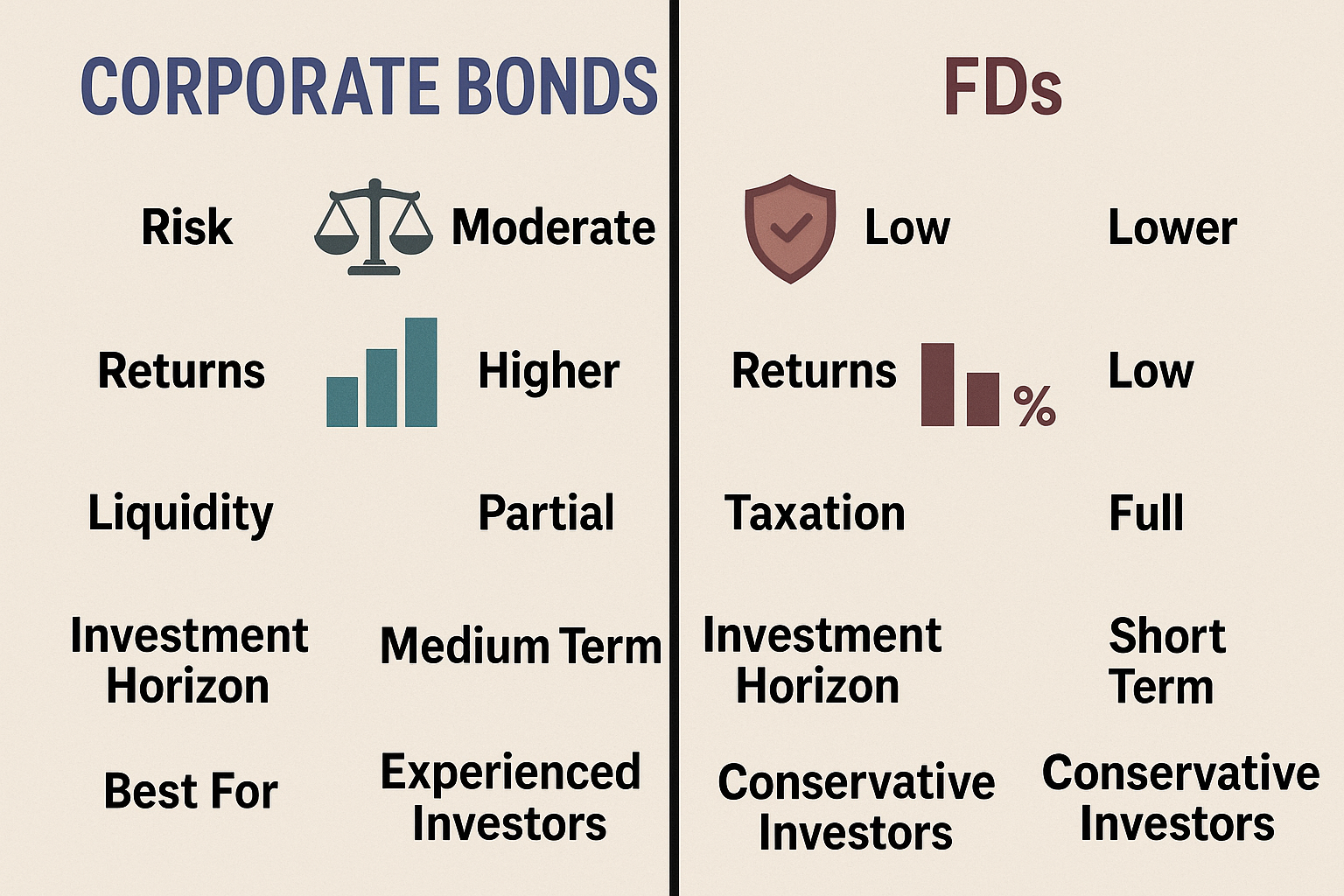

7. Money Market vs. Other Investments

| Feature | Money Market | Stocks | Bonds | Mutual Funds |

|---|---|---|---|---|

| Risk | Low | High | Low–Medium | Low–High |

| Returns | 5–7% | 12–20% | 6–9% | 6–20% |

| Tenure | <1 year | Long-term | 1–30 years | Flexible |

| Best for | Short-term | Growth | Stability | Diversification |

Insight: OECD studies show money market instruments reduce portfolio volatility by 15–20% when paired with stocks.

8. Who Should Invest in the Money Market?

Perfect for:

- Beginners: Safe entry to investing in India with ₹100 SIPs.

- Risk-Averse: Seeking stability over stock market swings.

- Short-Term Savers: Planning for goals like health insurance or travel (1–12 months).

- Portfolio Balancers: Offset risk from stocks or equity funds.

Example: Ankit, a 28-year-old from Bengaluru, parks ₹50,000 in a T-Bill for 6 months to fund his sister’s wedding, earning ₹1,250 vs. ₹750 in savings.

9. How to Start Investing in the Money Market in 2025

Ready to dive in? Follow these steps:

- Set Goals

- Short-term: Health insurance, vacation (3–12 months).

- Emergency fund: ₹50,000 in 6 months.

- Assess Risk

- Prefer safety? Choose T-Bills or MMMFs.

- Moderate risk? Try AAA-rated CPs or debt funds.

- Open an Account

- Platforms: RBI Retail Direct (free), Zerodha, Groww.

- Process: KYC with PAN, Aadhaar (10 mins).

- Cost: No fees for direct T-Bills; MMMFs have low expense ratios (0.2–0.5%).

- Choose an Instrument

- Beginners: T-Bills (5–6.5%) or HDFC Money Market Fund (6.8%).

- Research: Check yields on RBI website, Moneycontrol.

- Minimum: ₹10,000 (T-Bills), ₹100 (MMMFs).

- Invest

- Buy T-Bills via RBI Retail Direct auctions.

- Start MMMF SIPs on Groww (e.g., ₹500/month).

- Example: ₹50,000 in a 182-day T-Bill at 5.5% = ₹1,375 profit.

- Monitor

- Track NAVs (MMMFs) or maturity (T-Bills).

- Rebalance: Roll over T-Bills or shift to debt funds.

10. Money Market in India 2025: Trends and Opportunities

- High Yields: RBI’s 6.5% repo rate boosts T-Bill yields (5–6.5%).

- Digital Access: RBI Retail Direct, Zerodha make investing easy.

- Growth: ₹15 lakh crore daily turnover (RBI, 2025).

- Green Instruments: Green T-Bills for sustainable projects gaining traction.

11. Frequently Asked Questions (FAQ)

- What is the money market?

A short-term lending/borrowing market for banks, governments, and companies. - Is the money market safe?

Very safe, especially T-Bills (RBI-backed); CPs carry slight risk. - How does it fit into personal finance?

Funds short-term goals like health insurance; offers safe returns. - Where to invest in the money market?

RBI Retail Direct, Zerodha, or MMMFs via Groww. - Best money market option for 2025?

T-Bills (5–6.5%) or MMMFs (6–7%) for safety.

12. Conclusion

The money market is your financial safe haven in 2025, offering stability in a volatile world. With India’s economy booming (7.8% GDP growth, RBI) and yields beating savings accounts, it’s perfect for short-term goals like funding health insurance or saving for a big purchase. Start with ₹100 in an MMMF or ₹10,000 in a T-Bill via RBI Retail Direct. Pair it with our budget planner and explore stocks (stock market post) or bonds (bonds post) for a balanced portfolio. Take control of your personal finance today!