Best Low-Risk Investments for Beginners in India (Under ₹1,000 Start)

The word “investment” often conjures images of crores in stocks, mutual funds, or real estate. If you’re holding just ₹1,000, it might feel too small to make a difference. But here’s the truth: you don’t need lakhs to start investing in India. With as little as ₹500 or ₹1,000, you can begin building wealth safely, without falling prey to scams.

This post explores the best low-risk investment options for beginners in India, designed for small budgets. Our goal is education, not financial advice. We’ll help you understand safe, reliable options and steer clear of risky traps.

Why Start Small?

- Build a Habit: Regular saving teaches discipline.

- Gain Confidence: Low-risk options ensure your money is safe while you learn.

- Learn the Ropes: Understand how investments work without high stakes.

Think of investing like exercising: you don’t lift 100 kg on day one. Start small, build strength, and grow over time.

1. Recurring Deposits (RDs) – Discipline with Guaranteed Returns

- Minimum Investment: ₹500–₹1,000/month (varies by bank).

- Where to Invest: Public/private banks or India Post.

- Returns: ~5%–7% annually (2025 rates, e.g., SBI offers ~6.5%).

- Risk Level: Very low (insured up to ₹5 lakh by DICGC).

- Lock-in: 6 months to 10 years (flexible tenures).

Example: Invest ₹1,000/month in an RD at 6% for 1 year. You’ll have ~₹12,400 by the end, including interest.

Why It’s Great for Beginners: RDs enforce regular saving, like a subscription to your financial future. They’re simple, safe, and widely available across India.

Pro Tip: Compare RD rates on BankBazaar or check with local banks for promotional offers.

2. Post Office Schemes – Trusted and Government-Backed

- Options: Post Office Recurring Deposit, National Savings Certificate (NSC), Kisan Vikas Patra (KVP).

- Minimum Investment: ₹100–₹1,000 (varies by scheme).

- Returns: ~6.5%–7.5% (fixed, set by the government in 2025).

- Risk Level: Near zero (government guaranteed).

- Lock-in: Varies (e.g., 5 years for NSC, ~10 years for KVP).

Example: ₹1,000/month in a Post Office RD at 6.8% yields ~₹75,000 after 5 years.

Why It’s Great: Trusted by millions, Post Office schemes are accessible even in rural India, with guaranteed returns and no market risk.

Learn More: Explore our guide to Post Office savings for a detailed comparison.

3. Mutual Funds via SIPs – Step into Wealth Creation

- Minimum Investment: ₹500–₹1,000/month.

- Where to Invest: Platforms like Groww, Zerodha Coin, Paytm Money, or Kuvera.

- Safer Categories: Debt Mutual Funds, Index Funds (e.g., Nifty 50 Index Fund).

- Returns: ~6%–10% annually (long-term average, not guaranteed).

- Risk Level: Low to moderate (debt funds are safer than equity).

Example: ₹1,000/month in a debt mutual fund at 8% for 5 years grows to ~₹73,000 invested, potentially reaching ~₹90,000 with compounding.

Why It’s Great: Systematic Investment Plans (SIPs) spread risk over time, teaching you the power of compounding. They’re ideal for beginners dipping into markets.

Pro Tip: Start with debt funds for stability. Use our SIP calculator to estimate returns.

4. Sovereign Gold Bonds (SGBs) – Gold with Extra Benefits

- Minimum Investment: 1 gram of gold (~₹7,500 in 2025, but you can pool funds).

- Where to Invest: RBI, banks, or platforms like Zerodha.

- Returns: 2.5% annual interest + gold price appreciation.

- Risk Level: Very low (government-backed).

- Lock-in: 8 years (exit option after 5 years).

Why It’s Great: Indians love gold, but physical gold involves risks (theft, storage costs). SGBs are digital, safe, and pay extra interest, making them a smart choice.

Fun Fact: If gold prices rise 5% annually, ₹7,500 in SGBs could grow to ~₹11,000 in 8 years, plus interest.

5. Public Provident Fund (PPF) – Your Long-Term Safety Net

- Minimum Investment: ₹500/year (max ₹1.5 lakh/year).

- Returns: ~7.1% tax-free (2025 rate).

- Risk Level: Zero (government-backed).

- Lock-in: 15 years (partial withdrawals after 5 years).

Example: ₹1,000/year at 7.1% compounds to ~₹28,000 in 15 years, tax-free.

Why It’s Great: PPF is perfect for long-term goals like retirement or children’s education. Its tax benefits and safety make it a must-have for beginners.

Tip: Combine PPF with SIPs for a balanced portfolio. Check our PPF guide for details.

6. Digital Gold – Small Chunks, Short-Term Caution

- Minimum Investment: ₹10 (via PhonePe, Paytm, Groww).

- Returns: Tied to gold price fluctuations.

- Risk Level: Medium (not government-backed, price volatility).

- Lock-in: None (sell anytime).

Why It’s Great: Ideal for micro-savings (₹10–₹100). It’s a fun way to start but less secure than SGBs for long-term holding.

Caution: Shift to SGBs or other safer options for larger sums or long-term goals.

Pro Tip: Use digital gold for small, short-term savings, but avoid storing large amounts due to price risks.

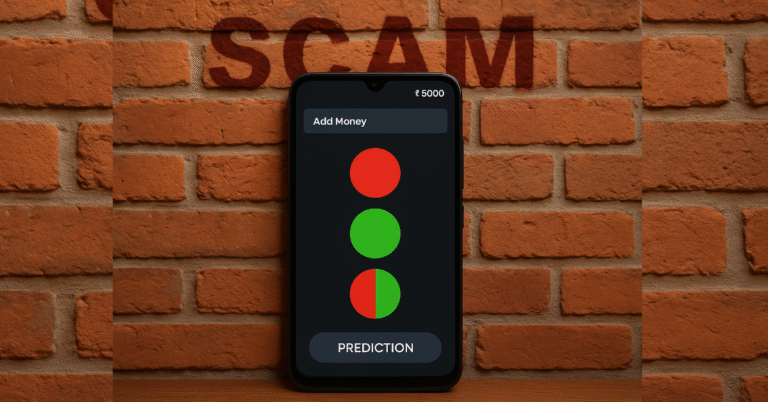

Avoid These Traps

Your ₹1,000 is precious. Steer clear of these scams promising quick riches:

- Color Prediction Games: Illegal and designed to drain your money.

- Money Doubling Apps: Fake promises with no returns.

- “₹500 to ₹50,000” Schemes: Too good to be true.

- Unverified Crypto Apps: High risk of fraud.

Rule of Thumb: If it sounds too good to be true, it probably is. Stick to regulated platforms and government-backed schemes.

Conclusion: Small Steps to a Big Future

With just ₹1,000, you can start investing in India without fear. Here’s a quick recap:

- RDs and Post Office Schemes: Safest for beginners, perfect for discipline.

- SIPs: Ideal for slow, steady wealth creation.

- SGBs and PPF: Government-backed for long-term security.

- Digital Gold: Fun for micro-savings, but use cautiously.

The real power of ₹1,000 isn’t the amount—it’s the habit of investing. Start small, stay consistent, and grow into a confident investor.

CrunchyFin’s Reminder: Every rupee invested is a step toward financial freedom. Ready to begin? Explore our beginner’s guide to personal finance or try our budgeting tools to track your progress.