How to Get Emergency Money for Hospital Bills When Insurance Is Pending

Your loved one is fighting for their life. The hospital wants money. Your insurance is stuck or useless. This is pure panic. Forget fancy advice. This is your immediate action plan for getting funds in India and the traps you MUST avoid.

The Ugly Truth: Why Insurance Fails You NOW

Many think insurance is a magic shield. In a medical emergency in India, it’s often a slow, frustrating process, or simply doesn’t cover what you expect:

- Hospital Not Covered: Often, the nearest or best hospital isn’t in your policy’s “cashless network.” You pay upfront.

- “Pending Pre-Auth”: The hospital sends papers, but the insurance company (TPA) is slow, wants more documents, or finds a minor error. Treatment stops without approval.

- Waiting Periods/Exclusions: Your policy might not cover pre-existing conditions or certain treatments immediately.

- Document Mess: One missing signature or unclear report can freeze everything.

Result: Your loved one needs care, and YOU need cash. This is where desperation sets in.

Your FAST Money Tricks (Act NOW!)

You have no time. Do these things:

- Attack the Hospital Billing Desk:

- Find Who: Ask for the Billing Head, Hospital Administrator, or Medical Social Worker. Be firm, but polite.

- Your Script: “My family member is critical. Insurance is stuck/hospital not covered. What is the absolute minimum for treatment to start/continue? Can we get an installment plan? Are there charity funds?”

- Bargain: Ask for an itemized bill. Question every charge. “Can we do a cheaper test? Is this really needed now?” They might reduce the bill.

- Mobilize Your Inner Circle – Your Real Power:

- Call EVERYONE: Parents, siblings, close friends, trusted relatives, even distant cousins. This is your quickest, safest money.

- Don’t Be Ashamed: Swallow your pride. Your family needs you. True friends and relatives will help.

- “Even ₹500 Helps”: Small amounts from many add up fast. Just ask.

- Employer: Check if your or the patient’s company offers emergency medical loans or salary advances. This is a common, fast option.

- Go Social – Use Your Network to Fundraise:

- WhatsApp/Facebook Post: Write a short, heartfelt message. Patient’s name, condition, hospital, exact money needed.

- Add Proof: A photo (of patient if consented, or a bill) makes it real.

- Direct Bank Details: Include your Bank A/c No., IFSC, UPI ID directly. This is the fastest way for people to send money.

- Crowdfunding Platforms (for bigger needs): Sites like Milaap, ImpactGuru, Ketto are famous in India.

- Pro: Can raise big sums, no repayment. They help verify your story.

- Con: Takes a day or two to set up. Start sharing the link everywhere, immediately!

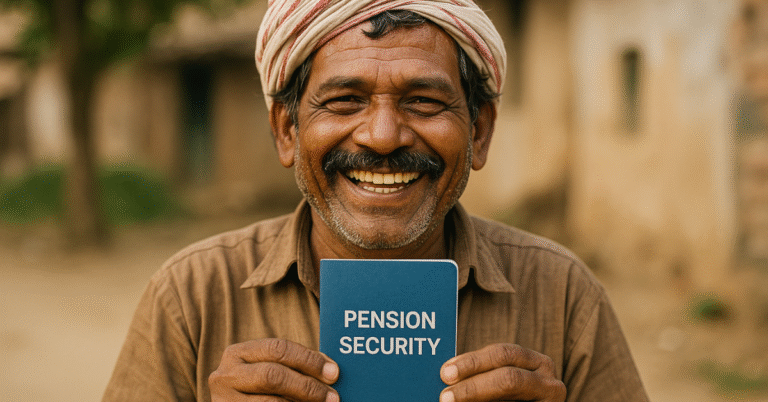

Government Schemes: Your Right to Help (Don’t Ignore These!)

Many average Indian families, even without BPL cards, are eligible.

- Ayushman Bharat – PMJAY:

- What: ₹5 Lakh cashless cover for serious treatments.

- How to Check: Go to the Ayushman Mitra desk at the hospital (they exist in empanelled hospitals). They check with Aadhaar. Or beneficiary.nha.gov.in, enter mobile, get OTP, select location, and search. Also, visit any Common Service Centre (CSC).

- Why it’s HUGE: If you qualify and the hospital is empanelled, it covers major costs instantly.

GLOBAL NGO Reality Check:

While global NGOs exist, they rarely provide direct, immediate financial aid for individual hospital bills for the general public. Their focus is usually:

- Disaster Response: Like after floods, earthquakes (e.g., Doctors Without Borders/MSF for crisis zones).

- Specific Diseases: Some focus on cancer, HIV, TB.

- Long-Term Health Projects: Building clinics, training staff, public health initiatives.

Don’t count on them for YOUR immediate hospital bill. Your best bet is always local: family, community, government schemes, and Indian crowdfunding platforms.

WARNING! DANGEROUS TRAPS to AVOID (These Will DESTROY You!)

Desperation can make you blind. AVOID THESE AT ALL COSTS:

- Credit Cards for Big Bills:

- Quick Fix: Yes, money is instant.

- The Debt Trap: Credit cards have SHOCKINGLY HIGH interest (2-4% per month!). If you can’t pay the entire bill back in 30-45 days, you’ll be buried in debt far worse than the hospital bill. Only use for tiny amounts you can clear immediately.

- “Instant” Loans from Shady Apps/Local Moneylenders (Loan Sharks):

- False Hope: When banks say no, these seem like salvation.

- The RUIN: They charge ILLEGAL, UNBELIEVABLE interest (5-10% per month or more!). They use threats, harassment, and illegal methods for recovery. NEVER, EVER, EVER go to these sources. They will ruin your family’s life, not save it.

- Giving Up on Insurance Because it’s “Denied” or “Pending”:

- False Belief: “It’s over.”

- The REALITY: Claims are often denied for fixable reasons (missing papers, slow hospital, pre-auth issues). This is common!

- WHAT TO DO:

- Stay Strong: Don’t give up.

- Demand Answers: Ask the hospital’s TPA desk or call your insurer: “WHY is it stuck? What specific document or step is missing?”

- Push Hard: Follow up constantly.

- Focus on Reimbursement: If cashless isn’t working, confirm you can pay now and claim later. Keep EVERY SINGLE ORIGINAL BILL, report, discharge summary. You NEED these to get your money back!

Your Loved One Needs You Strong. Fight Smart!

You are in a battle. Use these fast, direct methods to get funds. Your family and community are your most powerful allies. Utilize government help that is your right. And above all, protect your family from debt traps that will create a bigger crisis later. You are fighting for a life fight smart.