What is Health Insurance? Types and Benefits Explained for Indian Families in 2025

Imagine a ₹5 lakh hospital bill wiping out your savings health insurance prevents that. With India’s 6.2% GDP growth (RBI, 2025) and rising medical costs (12% inflation, IRDAI 2024), health insurance is a must for financial security. Regulated by the IRDAI, it covers over 50 crore Indians (IRDAI, 2025), yet 30% remain uninsured. This beginner’s guide explains health insurance in India, its types, benefits, and how it ties to personal finance goals like investing in stocks (post) or forex trading (post). Whether you’re a young professional or a family, learn how to protect your wealth in 2025. Note: Data based on 2024; check IRDAI for updates.

1. What is Health Insurance?

Health insurance is a contract where an insurer covers medical expenses (e.g., hospital bills, surgeries) in exchange for premiums. In India, it’s regulated by the IRDAI, ensuring transparency and consumer protection.

- Key Features:

- Coverage: Hospitalization, surgeries, diagnostics, pre/post-hospital costs.

- Premiums: ₹5,000–20,000/year for ₹5 lakh cover (IRDAI, 2024).

- Cashless Claims: Treated at network hospitals without upfront payment.

- Tax Benefits: Up to ₹25,000 deduction under Section 80D (Finance Act 2025).

- India Context: 50 crore insured; ₹17,450 crore infused into PSU insurers (2019–22, IRDAI).

- Analogy: Like a financial shield, protecting your budget planner (post) savings from medical emergencies.

- Why It Matters: Complements mutual funds by securing health while you invest.

2. How Does Health Insurance Work?

You pay an annual premium, and the insurer covers medical costs up to a sum insured (e.g., ₹5 lakh). Claims can be cashless (network hospitals) or reimbursed.

- Key Concepts:

- Sum Insured: Coverage limit (e.g., ₹5–50 lakh).

- Premium: Annual cost, varies by age, health, coverage.

- Network Hospitals: 10,000+ in India (e.g., Apollo, Fortis, per IRDAI).

- Claim Process: File via TPA (Third Party Administrator); cashless takes 2–4 hours.

- Example (Illustrative):

- Priya, 30, pays ₹10,000/year for ₹5 lakh cover with Star Health.

- Hospital bill: ₹2 lakh (heart surgery). Insurer pays directly; Priya pays nothing.

- Without insurance: ₹2 lakh from savings, disrupting her SIP (post).

- India Fact: 11% CAGR in insurance premiums (2020–23, IRDAI).

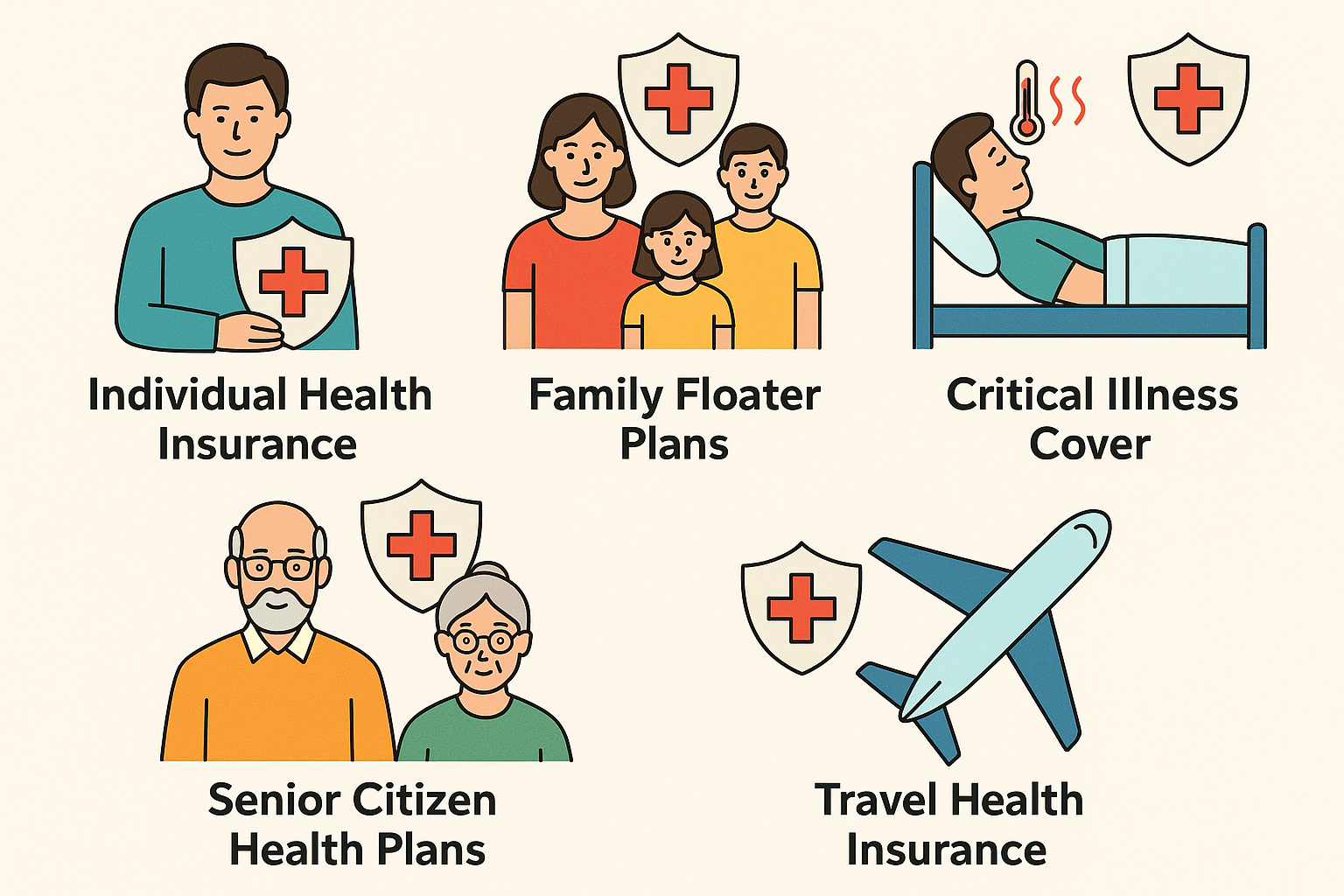

3. Types of Health Insurance in India

- Individual Health Insurance:

- Covers one person; ideal for young professionals.

- Cost: ₹5,000–15,000/year for ₹5 lakh cover.

- Example: HDFC ERGO’s Optima Secure.

- Family Floater Plans:

- Covers entire family under one policy.

- Cost: ₹10,000–25,000/year for ₹10 lakh cover.

- Example: ICICI Lombard’s Complete Health Insurance.

- Senior Citizen Plans:

- For 60+ years; covers age-related ailments.

- Cost: ₹20,000–40,000/year for ₹5 lakh cover.

- Example: Bajaj Allianz’s Silver Health Plan.

- Critical Illness Plans:

- Lump-sum payout for diseases (e.g., cancer, stroke).

- Cost: ₹3,000–10,000/year for ₹10 lakh cover.

- Example: Aditya Birla’s Activ Health.

- Top-Up/Super Top-Up Plans:

- Extra cover at low cost; activates after base policy limit.

- Cost: ₹2,000–5,000/year for ₹20 lakh cover.

- Example: Religare’s Super Top-Up.

Insight: Families should choose floater plans; seniors need critical illness add-ons.

4. Benefits of Health Insurance in 2025

- Financial Security:

- Covers ₹5–50 lakh hospital bills, saving emergency funds (post).

- Example: Anil’s ₹3 lakh bypass surgery covered, preserving his stock portfolio (post).

- Tax Savings:

- ₹25,000–75,000 deduction under Section 80D (Finance Act 2025).

- Example: Priya saves ₹7,500 tax on ₹25,000 premium.

- Rising Costs Protection:

- Medical inflation at 12% (IRDAI, 2024); ₹5 lakh cover ensures affordability.

- Cashless Treatment:

- 10,000+ network hospitals; no upfront payment.

- Holistic Planning:

- Frees savings for mutual funds (post) or forex trading (post).

- India Fact: ₹17,450 crore PSU insurer infusion (2019–22) strengthened claim payouts.

5. Risks of Not Having Health Insurance

- Financial Drain:

- Average heart surgery: ₹2–5 lakh (IRDAI, 2024).

- Example: Anil’s ₹3 lakh bill wipes out his SIP savings.

- Delayed Treatment:

- 30% uninsured delay care due to costs (IRDAI, 2025).

- Debt Trap:

- 20% of medical loans in India for emergencies (RBI, 2024).

- Tax Loss:

- Miss ₹25,000–75,000 deductions under Section 80D.

- Fix: Start with ₹5,000 premium; use budget planner (post) to allocate funds.

6. How to Choose Health Insurance in India 2025

- Assess Needs:

- Family size, age, health conditions (e.g., diabetes).

- Example: Priya, 30, needs ₹5 lakh floater plan for her family.

- Compare Plans:

- Use Policybazaar, check sum insured, premiums, network hospitals.

- Example: HDFC ERGO vs. Star Health for cashless options.

- Check Exclusions:

- Pre-existing diseases (1–4 year waiting period).

- Example: Diabetes covered after 2 years (IRDAI norm).

- Evaluate Add-Ons:

- OPD, maternity, critical illness riders.

- Cost: ₹1,000–5,000/year extra.

- Buy Early:

- Lower premiums for young buyers; avoid waiting periods.

- Use Budget Planner:

- Allocate ₹5,000–20,000/year via budget planner (post).

Pro Tip: Pair with term insurance (post) for complete protection.

7. Health Insurance vs. Other Investments

| Option | Risk Level | Benefit | Best for |

|---|---|---|---|

| Health Ins. | Low | Medical coverage | Financial security |

| Stocks | Medium | 10–15% returns | Wealth growth |

| Forex | High | High (leverage) | Hedging, speculation |

| Crypto | Very High | 50%+ returns | Speculation |

Insight: Health insurance ensures stability, unlike volatile forex (post) or crypto (post).

8. FAQ

- What is health insurance?

A policy covering medical expenses, regulated by IRDAI. - Is health insurance mandatory in India?

No, but 30% uninsured face financial risks (IRDAI, 2025). - How much does health insurance cost?

₹5,000–20,000/year for ₹5 lakh cover (IRDAI, 2024). - Can I claim tax benefits?

Yes, ₹25,000–75,000 under Section 80D (Finance Act 2025). - How does it fit personal finance?

Protects savings, supports mutual funds (post) or budget planner (post).