Gold vs Equity: Which Is the Better Hedge in 2025?

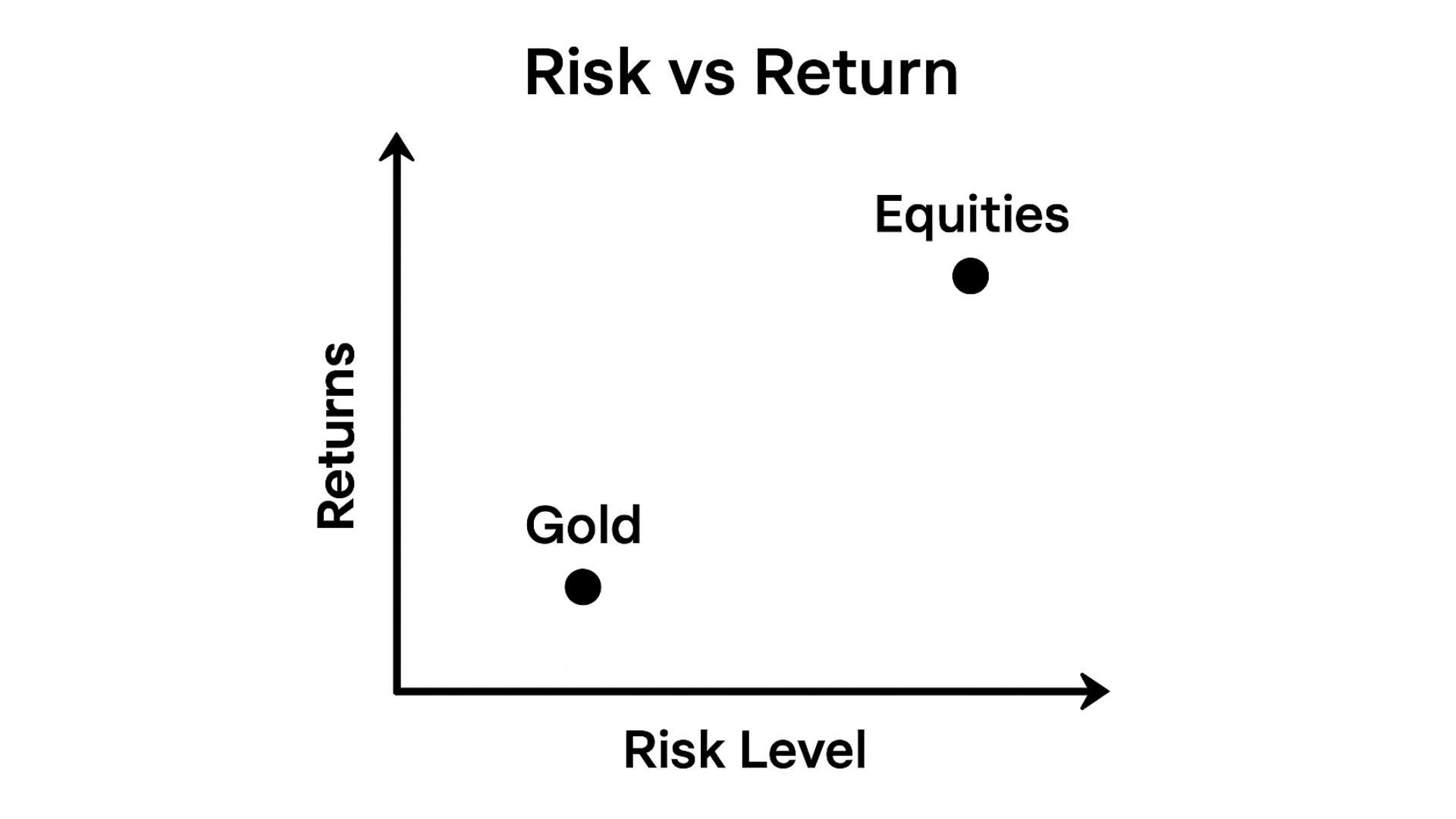

Investing in assets that protect your wealth from inflation and market volatility is crucial in today’s uncertain financial environment. Two of the most discussed options are gold and equities (stocks). But which is the better hedge in 2025? Let’s break it down in simple terms for practical, everyday investors.

What Makes Gold a Popular Hedge?

Gold has been considered a safe haven asset for centuries. Investors turn to gold when markets are volatile or when inflation erodes the value of cash.

Key features of gold:

- Tangible asset with intrinsic value

- Can be held physically (coins, bars) or digitally (gold ETFs, sovereign gold bonds)

- Acts as a hedge against inflation and currency depreciation

Pros of Investing in Gold:

- Protects against market crashes and geopolitical uncertainty

- Preserves wealth over long periods

- Highly liquid in most markets

Cons of Investing in Gold:

- No dividend or interest income

- Prices can be volatile in the short term

- Returns may underperform equities in the long term

- Investment strategies should follow global trends tracked by the World Gold Council

What Makes Equity a Hedge?

Equities, or stocks, represent ownership in a company. Unlike gold, equities provide the potential for capital appreciation and dividends, making them a growth-oriented hedge.

Key features of equities:

- Potential for long-term wealth creation

- Dividend income adds passive cash flow

- Historically outperforms inflation over long periods

- Must comply with regulations set by SEBI for safe investing

Pros of Investing in Equities:

- Higher long-term returns than gold

- Can hedge against inflation if companies pass costs to consumers

- Offers diversification across sectors and regions

Cons of Investing in Equities:

- Market risk: prices can fluctuate significantly

- Requires careful research and portfolio management

- Short-term volatility may be stressful for novice investors

Gold vs Equity: 2025 Market Perspective

| Feature | Gold | Equities |

|---|---|---|

| Primary Role | Safe haven, inflation hedge | Wealth creation, inflation-beating growth |

| Returns | Moderate, stable over long periods | Potentially higher, but volatile |

| Risk | Low in long term, moderate in short term | High volatility, market-dependent |

| Liquidity | High | High, but depends on market conditions |

| Income | None | Dividend payouts possible |

| Best For | Risk-averse investors, hedging inflation | Long-term growth-oriented investors |

How to Decide Between Gold and Equity in 2025

- Assess Your Risk Tolerance

- If you want stability and protection from inflation, lean toward gold.

- If you can tolerate volatility for higher growth, equities are suitable.

- Consider Investment Horizon

- Short-term (<3 years): Gold is safer as a hedge against sudden market corrections.

- Long-term (>5 years): Equities have higher potential to outpace inflation and build wealth.

- Diversification is Key

- Instead of choosing one, consider a balanced portfolio: gold for stability + equities for growth.

- Example: 20–30% in gold, 70–80% in equities depending on risk appetite.

Quick Tips for Investors in 2025

- Track inflation trends and economic indicators to decide timing.

- Use gold ETFs or sovereign gold bonds instead of physical gold for convenience and liquidity.

- Focus on blue-chip and index funds in equities for lower volatility and steady growth.

- Review your portfolio quarterly and rebalance based on market conditions.

Final Verdict

There’s no absolute winner both gold and equities serve complementary roles in a 2025 investment strategy. Gold acts as a shield against market turbulence and inflation, while equities offer long-term growth and dividend income. The best hedge is a diversified approach tailored to your financial goals, risk tolerance, and investment horizon.

Key Takeaways

- Gold = safety, stable returns, hedge against inflation

- Equities = growth, dividends, inflation-beating potential

- Balanced allocation reduces risk and maximizes wealth creation

- Monitor markets, rebalance portfolio, and stay informed

Read More Post Like This :

Corporate Bonds vs Fixed Deposits: Which One Is Better for You?

Discover the key differences between corporate bonds and bank FDs to make safe and profitable investment choices.