How Global Events Impact Commodity Prices (Oil, Gold, Wheat)

Commodity prices are highly sensitive to global events. Whether you’re investing in oil, gold, or wheat, understanding how external factors influence prices can help you make smarter decisions. Let’s explore how geopolitical tensions, economic shifts, and other global developments affect these essential commodities.

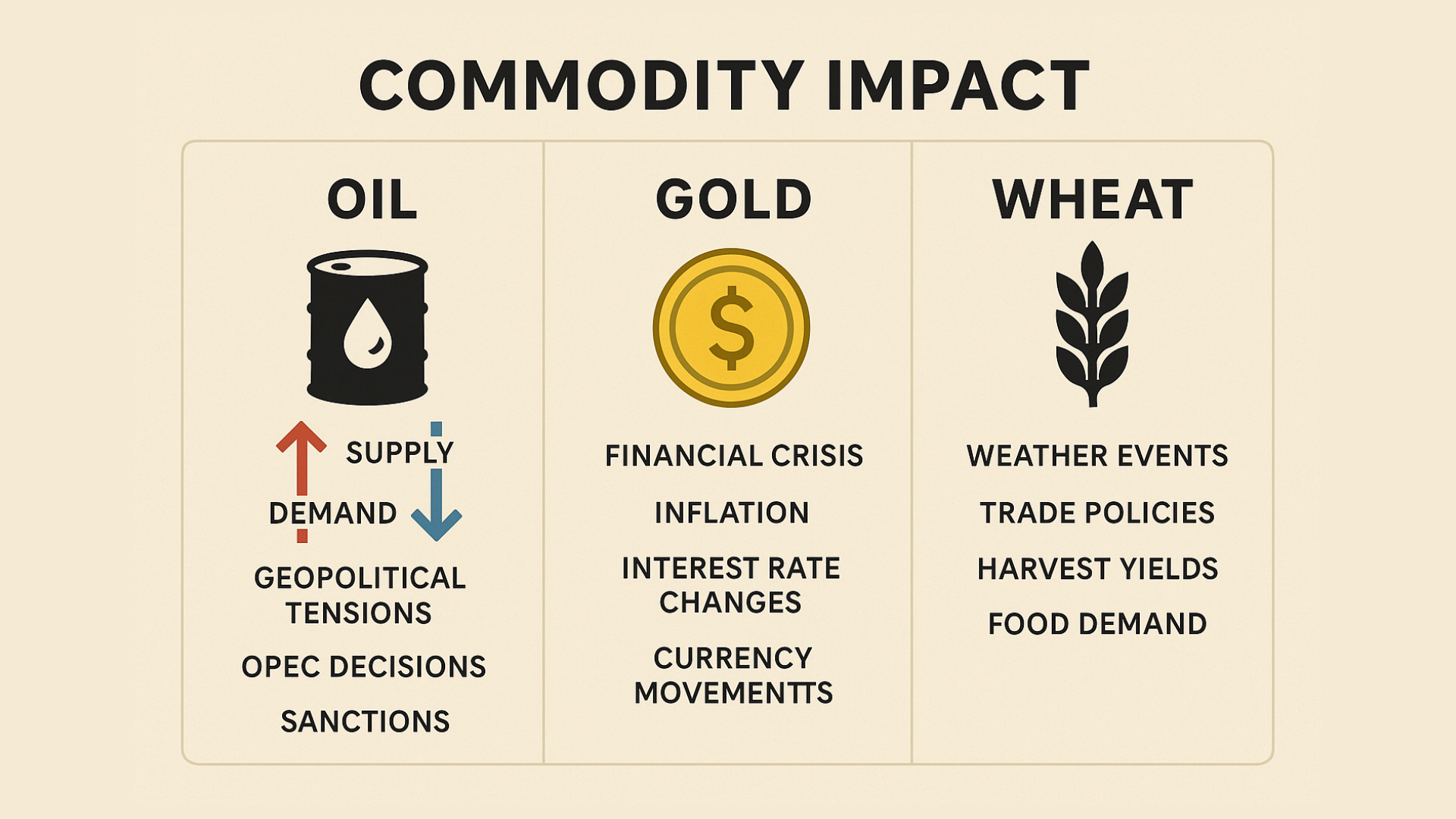

1. Oil: The Lifeblood of the Global Economy

Oil prices are influenced by supply-demand dynamics, geopolitical tensions, and economic policies. Key factors include:

- Geopolitical Conflicts: Wars or conflicts in oil-producing regions (like the Middle East) can cause sudden price spikes due to supply disruption.

- OPEC Decisions: The Organization of the Petroleum Exporting Countries controls production quotas that directly affect global oil prices.

- Global Economic Growth: A booming economy increases oil demand, while a slowdown reduces consumption and lowers prices.

- Natural Disasters & Climate Events: Hurricanes, floods, or other disasters can disrupt production and transportation, impacting prices.

Example: In 2022, oil prices surged due to the Russia-Ukraine conflict, demonstrating how geopolitical instability directly affects global energy costs.

2. Gold: The Safe Haven Asset

Gold is often seen as a hedge against uncertainty. Its price reacts strongly to global financial and economic events:

- Inflation & Currency Fluctuations: When inflation rises or currencies weaken, gold becomes more attractive as a store of value.

- Global Crises: Economic recessions, pandemics, or political instability drive investors to buy gold, increasing demand and prices.

- Interest Rates & Central Bank Policies: Lower interest rates make gold more appealing compared to interest-bearing assets, while higher rates can reduce demand.

Example: During the 2008 financial crisis, gold prices surged as investors sought stability amid collapsing stock markets.

3. Wheat: The Staple That Feeds the World

Wheat prices are influenced by climate, geopolitics, and global demand:

- Weather & Crop Conditions: Droughts, floods, or pests in major wheat-producing countries can sharply reduce supply, driving prices up.

- Global Trade Policies: Export bans, tariffs, and trade restrictions can disrupt supply chains, affecting global prices.

- Geopolitical Conflicts: Wars in wheat-exporting regions (e.g., Ukraine) can lead to price spikes and global food insecurity.

- Population Growth & Demand: Increasing demand in emerging economies can put upward pressure on prices.

Example: The Russia-Ukraine war in 2022 caused significant wheat price increases due to supply disruption from two major exporters.

4. Common Patterns Across Commodities

| Commodity | Key Global Influences | Price Behavior |

|---|---|---|

| Oil | Geopolitical conflicts, OPEC, economic growth | Volatile, spikes with supply shocks |

| Gold | Inflation, crises, interest rates | Safe haven, rises during uncertainty |

| Wheat | Weather, trade policies, conflicts | Sensitive to supply shocks, moderate volatility |

Key Insight: While each commodity responds differently, global instability generally increases prices due to risk premiums, supply constraints, or hedging behavior.

5. How Investors Can React

- Diversify Commodities Exposure: Don’t put all your investments in one commodity; spread across oil, gold, and agricultural products.

- Follow Global News: Monitor geopolitical events, central bank decisions, and trade developments.

- Use ETFs or Mutual Funds: For easier exposure without handling physical commodities.

- Consider Hedging Strategies: Futures contracts or commodity ETFs can help manage risk.

Final Thoughts

Commodity prices are never isolated from global events. Oil responds quickly to geopolitical conflicts, gold reacts to economic uncertainty, and wheat is sensitive to both climate and trade disruptions. Understanding these patterns allows investors to make informed decisions, hedge risks, and seize opportunities in volatile markets.

Key Takeaways

- Oil: Highly volatile, sensitive to conflicts and economic growth.

- Gold: Safe haven, rises during crises and inflation.

- Wheat: Price driven by weather, trade policies, and geopolitical disruptions.

- Staying informed and diversified is the key to navigating commodity investments.

Read More Posts Like This

- Corporate Bonds vs Fixed Deposits: Which One Is Better for You?

Discover the key differences between corporate bonds and bank FDs to make safe and profitable investment choices. - Building Your Financial Fortress

How to Link Insurance, Your Emergency Fund, and Investments