Why Does Cryptocurrency Have High Taxes in India? Reasons Explained in 2025

Imagine buying a Bitcoin for ₹1,000 and selling it for ₹1,500. Yay, ₹500 profit! But wait… the government takes ₹150 (30% tax) and ₹15 (1% TDS). Your ₹500 profit shrinks to ₹335.

Sounds harsh, right?

In 2025, India’s crypto taxes are among the world’s strictest, with a flat 30% tax on profits and a 1% Tax Deducted at Source (TDS). With over ₹16,000 crore traded in 2024 alone (WazirX data), millions of Indians are feeling this pinch. If you’re new to crypto, these taxes can feel like a financial trap. Let’s break down why they are so high and how you can manage them.

1. What Are Crypto Taxes in India?

Cryptocurrencies like Bitcoin and Ethereum are taxed as “Virtual Digital Assets” (VDAs) under the Income Tax Act, 1961, as updated by the Finance Act 2022. Here’s what beginners need to know:

- 30% Flat Tax on Profits: Any profit you make from selling, trading, or transferring crypto is taxed at a flat 30%. This rate is the same as the highest individual income tax bracket and applies regardless of whether your gains are short-term or long-term.

- 1% TDS on Transactions: Every sale or transfer of a VDA, whether for INR or another VDA, triggers a 1% Tax Deducted at Source. This is not an extra tax; it’s a prepaid tax. This amount is deducted by the exchange or buyer and deposited to the government, acting as a crucial tracking mechanism. You can later claim this TDS as a credit when you file your Income Tax Return (ITR).

- No Deductions or Loss Offsetting: This is a key reason crypto taxes are so harsh. Unlike stocks, you cannot offset losses from crypto transactions against other income. You can’t even use a loss from one crypto (e.g., selling Shiba Inu at a loss) to offset a gain from another (e.g., selling Ethereum at a profit). The only deduction allowed is the cost of buying the asset. You cannot deduct transaction fees, electricity costs from mining, or other related expenses.

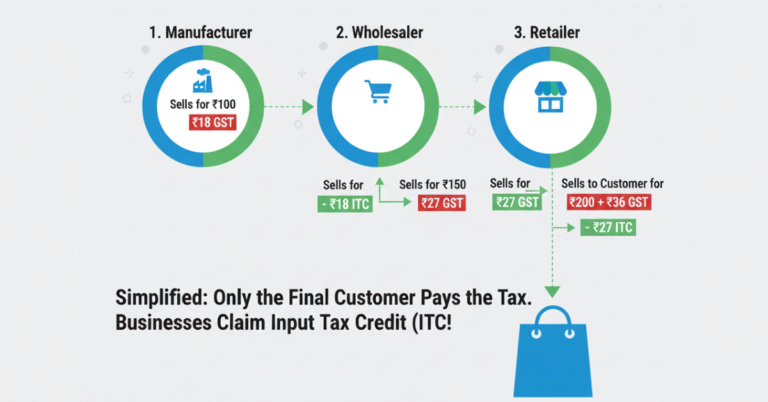

- 18% GST on Fees: In addition to income tax, you also pay an 18% Goods and Services Tax (GST) on the service fees charged by crypto exchanges. This further reduces your final returns.

Example: Priya buys 0.01 Bitcoin for ₹10,000 and sells it for ₹12,000. Her profit is ₹2,000.

- 30% Tax: ₹600 (30% of ₹2,000 profit)

- 1% TDS: ₹120 (1% of the ₹12,000 sale value)

- Total Taxes & Deductions: ₹720

- Priya keeps: ₹1,280.

- The ₹120 TDS can be claimed as a credit when she files her ITR.

India Fact: 10% of urban youth traded crypto in 2024 (WazirX survey), all facing these taxes.

2. Why Are Crypto Taxes So High? 5 Simple Reasons

India’s government has clear reasons for taxing crypto heavily. Think of it like a strict set of rules for a brand-new game here’s why:

2.1 To Stop Hidden Money

Why: Crypto uses wallet codes, not names, making it easy to hide income, like cash under the mattress. How Taxes Help: The 1% TDS tracks every transaction, and the flat 30% tax helps the government capture “black money” and prevent tax evasion. India Fact: ₹97 crore in GST evasion was caught from crypto platforms in 2024 (Economic Times), showing the government’s focus on enforcement.

2.2 To Curb Risky Trading

Why: Crypto prices can drop 20% in a single day (CoinGecko, 2024). The government views this as a high-risk, speculative market, unlike regulated stocks. How Taxes Help: High taxes make frequent, quick trades less profitable, nudging investors toward safer, less volatile assets.

2.3 To Fund India’s Growth

Why: Crypto trading is a massive source of potential revenue. Taxes collected from this market contribute to government projects like building schools, roads, and healthcare facilities. How Taxes Help: Your 30% tax and 1% TDS add crores to government revenue, directly supporting India’s 6.2% GDP growth (RBI, 2025). Your ₹600 tax on a ₹2,000 profit could help build a village classroom.

2.4 To Keep Up with Global Rules

Why: Countries like the US and UK tax crypto as a form of property. By implementing a clear tax regime, India aligns with global efforts to regulate and formalize the crypto market. How Taxes Help: It prevents traders from moving money to tax havens and brings India into international conversations on crypto regulation (G20 crypto tax talks, 2024).

2.5 To Protect the Traditional Economy

Why: Scams cost ₹5,000 crore in 2024 (RBI estimate), and crypto is not legal tender. The Reserve Bank of India (RBI) fears that an unregulated crypto market could destabilize the banking system and the wider economy. How Taxes Help: The taxes discourage risky behavior and fund oversight bodies like the Financial Intelligence Unit (FIU-IND) that combat crypto-related financial crimes.

3. How Do Crypto Taxes Actually Work?

Here’s a beginner’s guide to when and how taxes hit your crypto:

When You Pay Tax:

- Selling crypto for INR.

- Trading one crypto for another (e.g., Bitcoin for Ethereum). This is a taxable event.

- Using crypto to buy goods or services.

- Earning from staking, airdrops, or mining (taxable at your slab rate upon receipt, and then at 30% upon sale).

When You Don’t Pay:

- Holding crypto in your wallet.

- Moving crypto between your own wallets.

Filing Taxes: You must report your crypto profits in ITR-2 under the “Capital Gains” schedule. You can verify the TDS deducted by exchanges in your Form 26AS.

4. Crypto Taxes vs. Other Investments

This table shows why crypto taxes are particularly high when compared to other asset classes in India.

| Asset | Tax Rate | Loss Offset | Best For |

| Crypto | 30% + 1% TDS | No | Speculation |

| Stocks | 12.5% LTCG (>₹1.25L) | Yes | Long-term Growth |

| Bonds | 12.5% or slab rate | Yes | Stability |

| MFs | 12.5% LTCG (>₹1.25L) | Yes | Diversified Growth |

Note: For stocks and equity mutual funds, the long-term capital gains tax is 12.5% on gains exceeding ₹1.25 lakh, and you can use losses to reduce your tax bill. This is a major difference.

5. How to Handle Crypto Taxes Smartly in 2025

Don’t let taxes stop you—here’s how to manage them like a pro:

- Track Every Trade: Use crypto tax software like Koinly or CoinTracker to log all your buys, sells, and transfers.

- Choose Compliant Platforms: Use reputable Indian exchanges like WazirX or CoinDCX that handle the 1% TDS and provide a clear transaction history.

- File ITR Correctly: Declare all profits in ITR-2 and save a portion of your profits (at least 30%) in a separate account for tax season.

- Diversify Investments: Mix your crypto holdings with other investments like stocks or mutual funds for a more balanced portfolio with more favorable tax rules.

- Avoid Scams: Be wary of anyone promising “tax-free crypto” schemes they’re fake! Unreported crypto gains can face up to a 70% penalty.

Conclusion

India’s crypto taxes are like a pricey toll on your investment journey. They exist to stop scams, fund government growth, and keep the economy safe. For beginners, the taxes are tough, turning a ₹1,000 profit into ₹660.

But don’t let that discourage you. Knowledge is your superpower. By understanding the tax landscape, tracking your transactions meticulously, and planning ahead, you can trade smartly and stay on the right side of the law.