Build Your Emergency Fund: The Essential Safety Net for Everyone

What happens when your salary gets delayed, a family member falls sick, or a small home repair becomes urgent?

For millions of people around the world, moments like these cause real stress. You may have planned your budget carefully but life doesn’t always stick to the plan. Whether you earn a little or a lot, financial emergencies can shake your peace and stability.

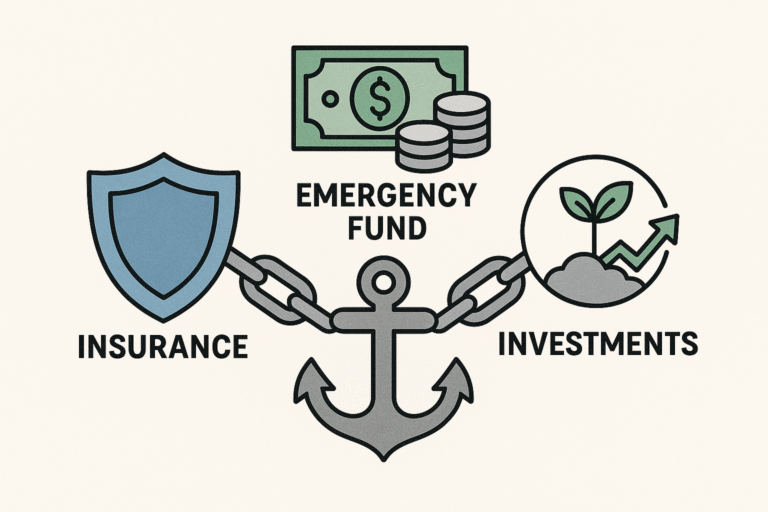

But there’s one powerful tool that helps anyone, anywhere, stay ready: an emergency fund.

An emergency fund is your personal dedicated amount of money set aside just for urgent, unexpected situations.

In this post, you’ll learn:

- What an emergency fund really means

- Why it’s essential for everyone, regardless of income

- How much you should aim to save

- Where to keep it safely

- And practical ways to build it step by step, no matter your earnings

What Is an Emergency Fund?

An emergency fund is a separate savings reserved for real, unavoidable needs like Sudden job loss, Emergency health expenses, Family support in crisis and Essential home or device repairs .

It’s not for planned purchases like vacations, shopping or monthly bills or entertainment. It’s your buffer when life surprises you in the worst way. The Emergency fund is like having an umbrella on a day you didn’t expect rain .

Why Everyone Needs an Emergency Fund

1. Avoid Falling into Debt

When this type of worst condition comes into someone’s life and there’s no backup, many people are forced to borrow from others or through high-interest credit. This leads to more pressure later. Emergency funds helps here and provide relife from this type of extra stress.

2. Protects Your Peace of Mind

Even a small safety net can give you confidence. You won’t feel helpless in a crisis. This mental security matters for your sleep, your relationships, and your choices.

3. Stabilizes Your Daily Life

Whether you earn minimum wage or run a business, emergencies can throw your entire budget off. An emergency fund helps you maintain your routine even in tough times keeping food on the table, rent paid, and essentials covered.

4. Prevents Small Issues from Becoming Big Problems

A small medical bill, a broken device, or a few days without work can become major setbacks. With a fund, you stay in control.

How Much Do You Need?

These are the non-negotiable costs that keep a roof over your head, food on your plate, and you functioning. Focus on survival, not luxuries:

- Rent or Home Loan EMI

- Utilities: Electricity, water, cooking gas, essential internet.

- Basic Groceries & Medicine

- Transportation: Fuel or public transport for work/school.

- Minimum Loan Payments: EMIs for existing loans.

- Insurance Premiums, Childcare, or Basic Family Responsibilities

Avoid counting: Dining out, entertainment, subscriptions you don’t need, luxury shopping. Those are wants, not essentials for an emergency.

Factors That Influence Your Ideal Fund Size:

While 3-6 months is a guideline, your personal situation might warrant more or less:

- Job Security: If you’re a freelancer, gig worker, or in an unstable industry, aiming for 6+ months offers a greater cushion than for someone with a very secure, full-time job.

- Health & Dependents: If you have ongoing medical needs or support children/elderly parents, a larger fund is a smart move.

- Income Stability: If your income is irregular or seasonal, saving more helps you weather the lean months.

- Risk Tolerance: How comfortable are you with uncertainty? More cautious individuals often prefer a larger fund.

Start with a “Mini Fund”: Your Powerful First Step

A mini fund like saving for one month’s expenses or even just a small amount of your money gives you quick protection and motivation to keep going.

This mini fund provides immediate protection against minor setbacks (like a sudden repair bill) and, crucially, gives you an incredible boost of confidence and motivation to keep going. Progress, not perfection, is the key here.

Where Should You Keep Your Emergency Fund?

The location of your emergency fund is critical. It must meet three criteria:

- Safe: Protected from market fluctuations or fraud.

- Liquid: Easily accessible when you need it, without penalties.

- Separate: Not mixed with your everyday spending money, so you’re not tempted to dip into it.

Ideal Options:

- A separate, dedicated Savings Account: With your regular bank or a digital-only bank. This is the simplest and safest option for most.

- A High-Yield Savings Account (HYSA): These accounts typically offer slightly better interest rates than standard savings accounts, meaning your money works a little harder while staying safe and accessible. (Check for options in your region like specific bank accounts or digital wallets that offer better interest on savings).

- A Sweep-in Fixed Deposit: Some Indian banks offer ‘sweep-in‘ facilities where money above a certain limit in your savings account automatically converts to an FD, earning higher interest, but can be ‘swept back’ to savings instantly if needed.

- A Secure Digital Wallet (with savings features): Some wallets offer savings-like features that keep your money separate and accessible.

Avoid These:

- Cash at Home: Not secure, no interest earned, and vulnerable to loss.

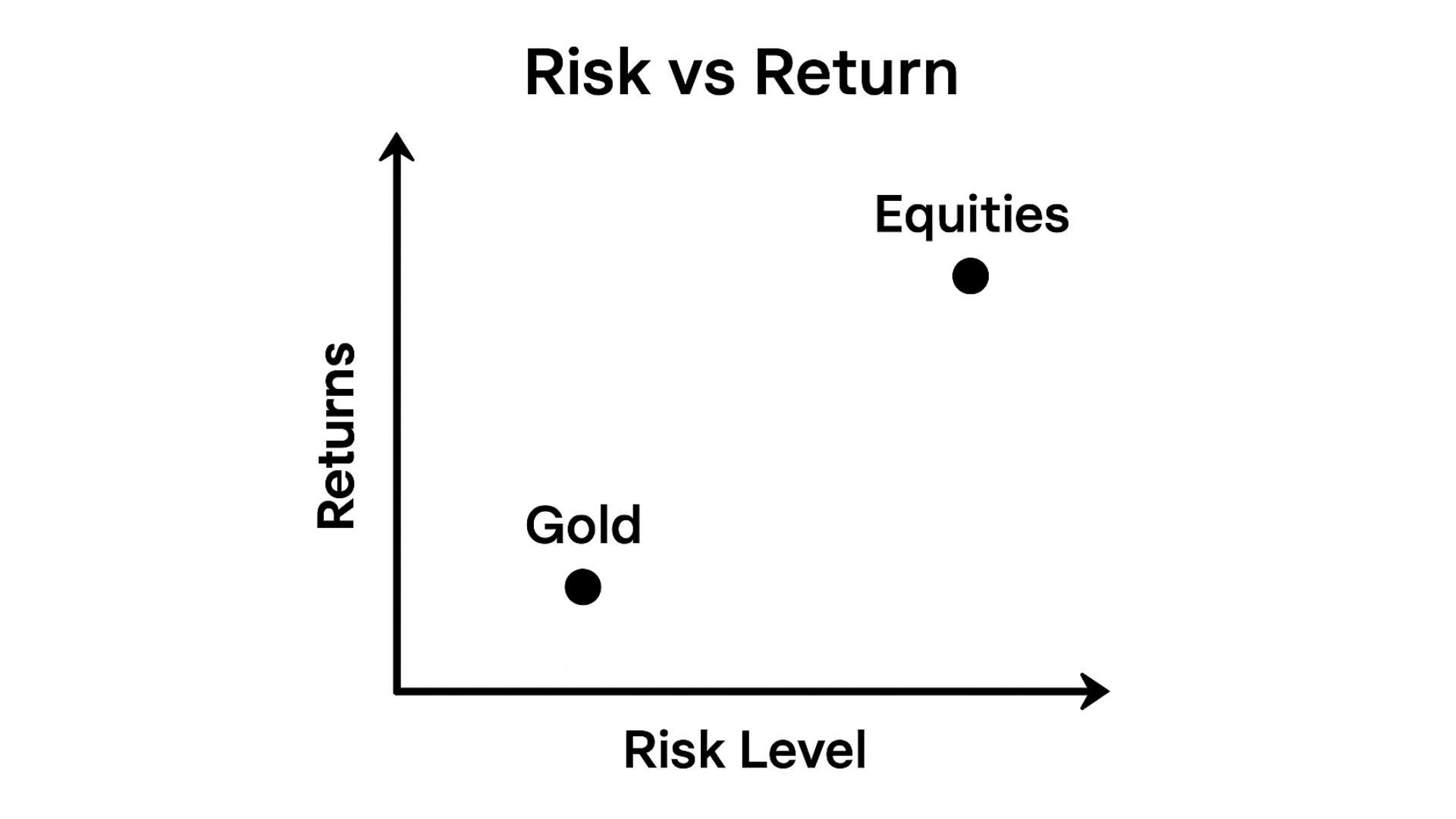

- Stocks or Risky Investments: Your emergency fund’s value should never fluctuate. You don’t want it to drop when you need it most.

- Your Main Checking/Current Account: Too easy to accidentally spend. Keep it out of sight, out of mind (until an emergency strikes).

How to Build Your Emergency Fund No Matter Your earn

This is where the rubber meets the road. No matter your current income, these actionable steps can help you build your safety net.

1. Set a Clear Goal (and Start Small!)

- Calculate Your Full Target: Based on 3-6 months of essential expenses, write down your total goal amount.

- Focus on the Next Small Step: If your goal is a big amount, don’t just see that number. Instead, think: “I’ll save a small amount this month.” Even better: “Make small goals, and they will become a big amount themselves.”

2. Automate Your Savings: “Pay Yourself First”

This is perhaps the most powerful strategy.

- Set up an Automatic Transfer: Right after you get paid, set up a recurring transfer from your main account to your separate emergency fund account.

- Consistency is Key: A little amount saved each week becomes a significant sum in a month, and a truly handsome amount over a year, all without you even thinking about it!

3. Cut a Few Temporary Costs

Look at your recent spending with a critical eye. This isn’t about deprivation, but about finding temporary savings you can redirect.

- Review Subscriptions: Are you using all your streaming services? Can you pause one for a few months?

- Eat Out Less: Cooking at home is often significantly cheaper. Can you swap 2-3 restaurant meals for home-cooked ones?

- Delay Non-Essential Shopping: Do you really need that new gadget or outfit right now? Postpone it for a few months and put that money into your fund.

- Small Changes Add Up: Your daily coffee or snack money, when saved over a month, can be substantial.

4. Save Any Extra Income (The “Windfall Wisdom”)

Did you receive an unexpected bonus, a tax refund, a cash gift, or a payment for a freelance task?

- Resist the Urge to Splurge: Instead of spending this “found money,” direct it straight to your emergency fund.

- Side Gigs: Even a few hours of part-time work, delivering for an app, or tutoring can quickly boost your savings.

- Selling Unused Items: Look around your home. Do you have old electronics, books, clothes, or furniture you no longer use? Sell them online (on platforms like OLX, Quikr, Facebook Marketplace) and deposit the earnings directly into your emergency fund. It’s a win-win: declutter and save!

5. Track Your Progress & Celebrate Milestones

Seeing your fund grow is incredibly motivating.

- Use a Simple Tool: A notebook, a mobile banking app, a spreadsheet, or even a visual chart on your fridge.

- Mark Your Wins: When you hit 10000$, then $25,000, then $50,000 celebrate these milestones! It reinforces positive habits and keeps you going.

6. Make It Non-Negotiable

Until your emergency fund reaches your target, treat it like a critical bill you absolutely must pay each month just like your rent, utilities, or loan EMIs. Prioritize it, and you’ll reach your goal faster than you think.

What to Do After Reaching Your Goal

Congratulations! Building a fully funded emergency fund is a huge financial accomplishment. Here’s what’s next:

- Celebrate! You’ve earned this peace of mind.

- Maintain It: If you ever need to dip into your fund for a true emergency, make it your top priority to replenish it as quickly as possible.

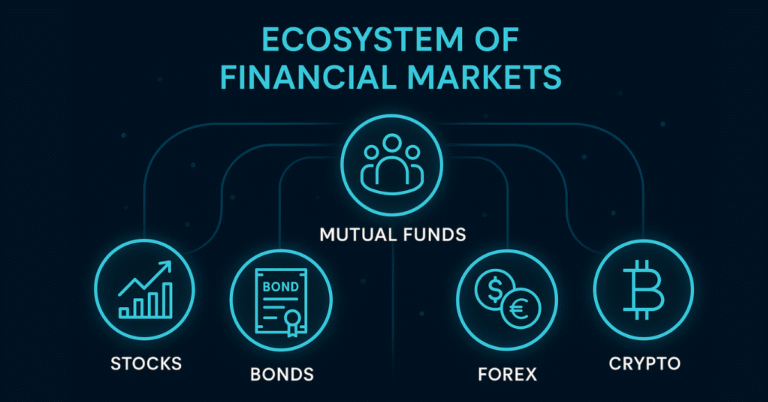

- Redirect New Savings: Once your emergency fund is solid, shift your focus to other long-term financial goals: investing for wealth creation, retirement planning, saving for a down payment, or aggressively paying off high-interest debt.

- Review Annually: Life changes. Your expenses might increase, or your family situation might evolve. Review your emergency fund target once a year to ensure it still adequately covers your needs.

One Comment