AI Financial Planners Are Here: 5 Red Flags to Watch For Before You Trust One

Would You Trust a Robot to Manage Your Life Savings?

It’s a question that used to belong in a sci-fi movie. Today, it’s a daily reality. AI financial planners and automated robo-advisors are everywhere, promising to manage your wealth management with cold, hard logic, free from human error. The allure is strong: a fast, seemingly bias-free way to make complex investing with AI decisions.

But here’s the secret no algorithm will tell you: money is deeply emotional. Your financial decisions are tied to your hopes, your fears, and your dreams things a machine can’t feel. As a human, expert guide here at CrunchyFin, I’m thrilled by the tech, but cautious about the trust we hand over.

Our Promise: By the end of this post, you’ll know exactly how to spot the five biggest warnings signs the “red flags” that tell you an AI financial planner is leading you in the wrong direction. You’ll learn to use AI as a tool, not as a replacement for your own human wisdom.

The Rise of AI Financial Planners

What Are They, Really?

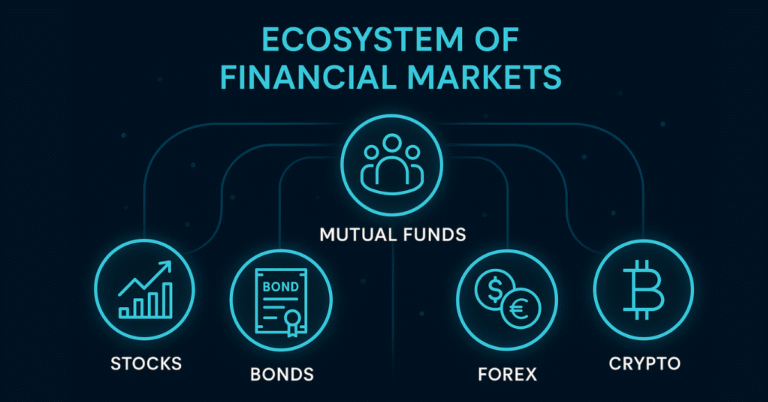

In plain English, an AI financial planner is a personal finance tool or program that uses machine learning and complex algorithms to give you money advice. Think of them as advanced calculators that can process massive amounts of data about your spending, goals, and the stock market, then recommend a financial move.

Robo-advisors like Wealthfront or betterment were the first wave; they automatically build and manage investment portfolios based on your risk profile. The new wave involves language models (like those behind ChatGPT) offering conversational, sophisticated advice—like: “Should I pay off my credit card or invest this bonus?” The increasing adoption of this technology shows that the future of AI in finance is here and rapidly evolving.

The core idea? Automation and speed. They aim to make expert advice accessible without the high cost of a traditional human advisor. They’re great for simplifying basic portfolio rebalancing and budgeting, but their true impact on risk management is still evolving.

Takeaway: AI financial planners use data and algorithms to automate basic advice and investing, but they are still just tools processing inputs.

Why People Trust AI With Money (and Why It’s Dangerous)

The Illusion of Perfect Accuracy

Why do so many people rush to hand over control to a digital advisor? Part of it is the powerful psychology of money. We often assume that because a computer is involved, the advice must be objective and perfectly accurate. This creates an illusion of accuracy the feeling that tech can’t make a mistake.

Another factor is fear of mistakes. Financial stress can be overwhelming. It feels easier to outsource the worry and decision-making. We think: “If the machine messes up, it’s not my fault.” We trust the tech because we don’t trust ourselves with complex wealth management.

But this trust is exactly what the Helpful Content System warns us about. You must remain in the driver’s seat. Your emotional intelligence in finance is irreplaceable, especially when the market dips or life throws you a curveball.

Takeaway: Trusting AI often stems from a fear of making a mistake, but giving up control means giving up the essential human perspective.

5 Red Flags Before You Trust an AI Financial Planner

Before you hand over your hard-earned money, look for these critical warnings signs. They separate a helpful tool from a potential financial scam.

1. It Promises Guaranteed Returns

- The Emotional Hook: You’ve probably seen the ads: “Predict the Market with 99% Accuracy!” This plays on our deepest financial desire certainty.

- The Practical Reality: No algorithm, no matter how advanced, can predict the future movements of a human-driven, global stock market. The moment a tool claims to offer guaranteed returns, it’s either misleading you or a scam. Markets are driven by fear, greed, politics, and unforeseen events (a pandemic, a war) inputs no AI can perfectly model.

- Actionable Tip: Any real financial advice includes the phrase “past performance is not indicative of future results.” If a tool omits this, walk away.

2. It Hides Its Data Sources

- The Emotional Hook: We trust what looks sophisticated. If the advice is presented as a complex chart, we assume it’s sound.

- The Practical Reality: This is about ethical AI and transparency. If a platform can’t clearly explain where its data comes from is it reliable, backtested, and current? you should be concerned about algorithmic bias. Is the AI trained on data that only favors high-net-worth investors? Does the advice work for everyday people with smaller savings?

- Actionable Tip: Look for an “About” or “Methodology” section. If the data sources and training models are a black box, the advice is not trustworthy.

3. One-Size-Fits-All Advice

- The Emotional Hook: Automation sounds efficient: one simple plan for everyone.

- The Practical Reality: Financial advice must be intensely personal. An AI doesn’t know you’re about to have a baby, that you hate your job, or that you might inherit a house. It sees numbers, not your life. If the recommended portfolio or budget is identical to your neighbor’s (even if you have similar income), the lack of personalization is a major flaw.

- Actionable Tip: Test the AI. Ask a unique, complex question about your life (e.g., “How should I invest knowing my partner has student loans and I might move abroad?”). If the answer is generic, the tool is too basic for real planning.

4. It Misses Emotional Context

- The Emotional Hook: In a crisis, we crave an unemotional, rational plan.

- The Practical Reality: True financial stress can’t be automated. AI can tell you that selling during a market crash is illogical, but it can’t feel the panic you feel when your retirement account loses 30% of its value. This is where human wisdom and empathy become critical. A human advisor understands the money psychology that makes you act irrationally; an AI just executes the logic.

- Actionable Tip: Never follow AI advice that makes you feel deeply uncomfortable or anxious. Your gut feeling is your brain recognizing an unquantifiable risk.

5. It Replaces Human Wisdom Entirely

- The Emotional Hook: We are tired of decision fatigue and want to completely offload our finances.

- The Practical Reality: AI provides data, charts, and forecasts. It doesn’t provide wisdom, empathy, or accountability. You need a human to help you navigate a financial divorce, talk to you about the fear of spending your retirement savings, or coach you on overcoming debt guilt. The best personal finance tools support human decision-making; they don’t replace it. This leads to a bigger question many of us ask: The Robo-Advisor Revolution: Is AI Managing Your Money Better Than You Can? The answer depends on your unique needs.

- Actionable Tip: View the AI as an extremely efficient intern. It can research, calculate, and report, but the final, complex decision is the CEO’s (that’s you!) to make.

Takeaway: Trust your instincts. If an AI promises guaranteed results, hides its data, or ignores your emotional, human context, it’s a huge risk.

The Smart Way to Use AI Financial Tools

Blending Logic with Life

The goal is not to fear AI, but to use it wisely. Think of your AI financial planner like a powerful digital advisor for the mundane tasks budget tracking, bill pay reminders, calculating basic portfolio drift, or compiling tax documents.

You bring the human judgment, and the AI brings the data processing power. This combined approach is the true power of modern wealth management.

3-Step AI Money Safety Checklist

- Verify the Data: Always check the sources, assumptions, and models. If the tool is recommending a high-risk move, ask: What data points is this based on?

- Add the Emotion: Before executing any major AI-recommended move (like a huge investment change), pause and ask yourself: How will I feel if this goes wrong? If the answer is panic, re-evaluate.

- Get a Second Opinion: Use the AI’s output as the starting point for a conversation with a trusted (human) friend, partner, or certified financial planner. Let the machine do the math, and let the humans do the thinking.

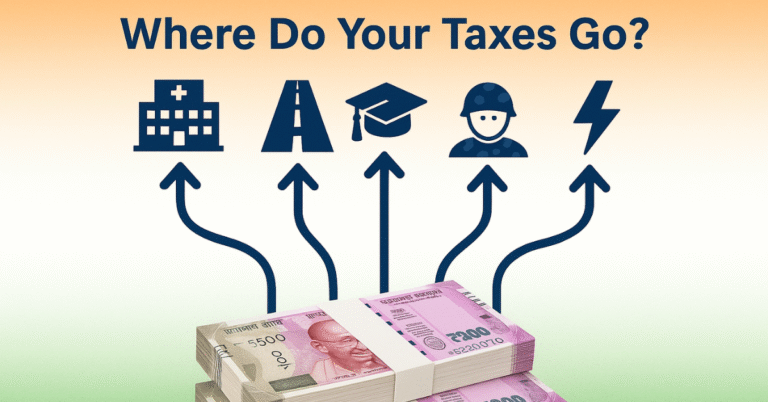

Your Dreams Are Not Data Points

AI can analyze your data, optimize your taxes, and perfectly rebalance your portfolio. But it can’t feel your dreams. It can’t feel the pride of paying off a mortgage or the fear of a volatile market. You are the expert in your life, and your values are the only compass that truly matters.

AI is a powerful calculator, not a trusted confidant. Use its logic to serve your own human wisdom.

What’s been your experience? Have you trusted an AI or robo-advisor with a big money decision? Share your story in the comments below!