Smart Money in 2025: How AI, Crypto, and Daily Savings Can Boost Your Wealth

Let’s Talk Money Not Dreams, But Deliberate Decisions

The financial world is full of noise apps promise quick money, crypto ads show fake gains, and influencers flash short-term success. But most people just want to feel secure when they check their bank balance.

At CrunchyFin, we believe finance should serve everyone, whether you earn ₹8,000 a month or ₹2 lakh. The truth is, you don’t need to chase unicorns. You need to understand what genuinely works, what’s real, and how to consistently use simple tools with a clear head. This guide cuts through the noise to give you a pragmatic roadmap for smart money in 2025.

AI in Finance (With Caveats)

AI isn’t just for Wall Street traders or sci-fi movies anymore. In 2025, it’s actively helping everyday Indians make smarter money decisions.

- Smart Budgeting: Apps like Walnut, Goodbudget, or YNAB use AI to learn your spending patterns. They don’t just track; they can alert you before you overspend in a category, identify recurring expenses you might forget, and highlight areas for potential savings.

- Auto-Saving & Investing Nudges: Tools like Jar (for gold savings) or Fello (for micro-investing) can round up your daily purchases, automatically putting the difference into savings or digital gold. Some new-age salary accounts even offer AI-powered financial health reports that, if you take the time to read them, can reveal surprising insights into your habits.

- Fraud Detection: AI algorithms are constantly working behind the scenes in banks and payment apps to detect unusual activity, protecting your money from scams and unauthorized transactions.

AI doesn’t make you rich on its own. It provides data and insights. Your action, diligence, and human judgment are the real drivers of growth.

A Word of Caution on AI:

While powerful, remember AI tools rely on your data. Always choose apps from reputable developers with strong encryption and clear privacy policies. Read these policies to understand how your data is used. Use strong, unique passwords and enable Two-Factor Authentication (2FA) on all financial apps. For complex financial planning (e.g., specific tax structures, large family finances), AI is a helper, but a SEBI-registered human financial advisor remains irreplaceable

Crypto Apps: Strategic Use in 2025

Let’s be clear: we’re not here to promote the next “moon coin” or guarantee overnight riches. Crypto, when used wisely and with a clear understanding of its risks, can be a small, diversified part of a modern financial portfolio. It’s about smart storage and long-term potential, not shortcuts.

Here’s a practical look at how you can potentially use crypto and what to be aware of:

| Purpose | Recommended Approach (with caveats) | Why? (and what to watch out for) |

| Safe Buying/Selling | FIU-IND registered Indian exchanges like CoinDCX, CoinSwitch Kuber, Mudrex, ZebPay and Delta Exchange India. | Pros: Beginner-friendly interfaces, secure KYC processes, compliance with Indian regulations, easier INR deposits/withdrawals. Watch Out: Always verify the exchange is FIU-IND registered to ensure compliance and avoid potential legal issues. Transaction fees apply. |

| Long-Term Storage | Hardware Wallets (e.g., Ledger Nano, Trezor) for significant amounts; Reputable Software Wallets (e.g., Trust Wallet, MetaMask for smaller holdings). | Pros: Gives you full control over your private keys, protecting assets from exchange hacks. Watch Out: If you lose your seed phrase, your crypto is permanently gone. These require more technical responsibility. Never share your seed phrase with anyone. |

| Recurring Investing | Platforms like Mudrex or Koinbasket (check their current FIU-IND status). | Pros: Automates small, regular investments (e.g., ₹100–₹500 per week) into top coins like Bitcoin or Ethereum. This is a form of Rupee Cost Averaging, smoothing out volatility over time. Watch Out: Still subject to market volatility. Consistency is key, not timing the market. |

Crucial Crypto Realities in India (2025):

- Volatility is real: Cryptocurrencies are highly volatile. Even established assets can see significant price swings daily. Never invest money you cannot afford to lose. They are not suitable for emergency funds.

- Regulatory clarity, but evolving: As of July 2025, cryptocurrencies are legal to hold and trade in India, but they are NOT legal tender. The government is focused on taxation and traceability.

- Taxation is Strict: You face a flat 30% tax on any profits from crypto transactions (selling, swapping, spending). Additionally, a 1% Tax Deducted at Source (TDS) applies to most transactions above a threshold (₹10,000 for general, ₹50,000 for specified persons). You cannot offset losses from crypto against other income, nor can you offset losses from one crypto against gains from another.

- Security is Your Responsibility: While exchanges work on security, the crypto space has higher risks than traditional banking. Be hyper-vigilant against scams, phishing, and fake apps. Always enable 2FA, use strong passwords, and understand how to secure your private keys.

- Limited Recourse: Unlike banks, there’s no central authority to reverse transactions or recover funds if you send them to the wrong address or fall victim to a scam.

Start small, learn consistently, and understand the risks. Crypto is a long road with a smart seatbelt (you), not a joyride to instant riches.

Real Ways to Save Money

Forget the sensational “save ₹1 lakh in 3 months!” content. Sustainable saving is about small, consistent wins that build confidence. Try these methods:

- The ₹20 Rule (or ₹50, or ₹100): Every time you know you’ve wasted money (a late fee you could have avoided, that extra sugary drink, an impulse buy you don’t need), immediately drop ₹20 (or your chosen amount) into a dedicated “regret jar” or transfer it to a separate digital savings account. You’ll either start saving more… or you’ll become more mindful of your spending. It’s a powerful behavioral nudge.

- The UPI Trick for Automated Savings: Set up a second, less-used bank account (maybe one with no debit card). At 7 a.m. every day, set up an auto-transfer of ₹50–₹200 from your main account via UPI. After a week or two, you won’t even notice the small deduction, but your savings will silently grow. Pro-tip: Don’t link your main UPI app to this second account to avoid easy withdrawals.

- Monthly Mini Goals: Challenge yourself with small, achievable goals: “This month, I’ll save enough to buy my brother’s birthday gift without guilt,” or “I’ll save for that specific new pair of shoes by avoiding eating out twice a week.” Small, real goals build self-trust and positive reinforcement.

- The “Pre-Commitment” Method: When you receive your salary, immediately set up auto-debits for your savings goals before you start spending. This “paying yourself first” strategy removes the temptation to spend it all.

Saving Habits for Every Income (Based on India’s Ground Realities)

Your financial journey is unique. Here’s tailored advice for different income levels in India:

Earning ₹8,000–₹15,000 per month? (Focus: Stability & Foundation)

- Build a Cash Jar/Digital Gold Habit: Start with visible, tangible savings. Use physical cash jars for daily savings or apps like Jar for digital gold. Digital gold can act as a hedge against inflation.

- One Financial Promise Per Month: Don’t overwhelm yourself. Focus on one small change: “This month, no tea stall chai outside home,” or “No impulse buys at the kirana store.” Consistency beats intensity.

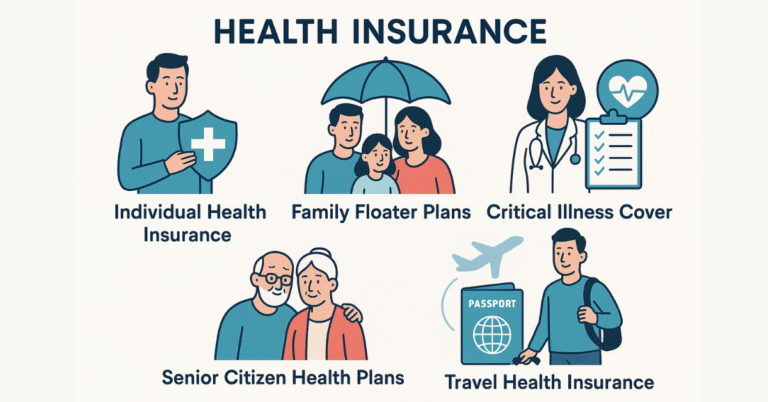

- Leverage Government Schemes: Start by opening a PMJDY zero-balance account for easy and free banking. Also, get low-cost insurance with PMJJBY (₹436/year for ₹2 lakh life cover) and PMSBY (₹20/year for ₹2 lakh accident cover). These plans are available under a special government campaign until September 30, 2025. Furthermore, plan for retirement with small, regular APY contributions. Finally, check your eligibility for Ayushman Bharat (PMJAY) for free healthcare. These small steps offer powerful protection and peace of mind.

- Inflation Alert: Even with low inflation (CPI was 2.82% in May 2025), cash savings slowly lose value. Once you’ve saved a small amount, you can try micro-SIPs in liquid mutual funds to earn better returns—but only if you understand how they work.

Earning ₹30,000–₹80,000/month? Focus on Growth & Protection:

- Use AI Budget Apps like Walnut or YNAB to track and control your spending.

- Start Mutual Fund SIPs with ₹500–₹1,000/month in diversified or balanced funds. Choose direct plans to save more.

- Invest Small in Crypto (1–2% of your income) only if you understand the risks. Use FIU-IND registered platforms.

- Build an Emergency Fund covering 3–6 months of expenses in a liquid mutual fund or high-yield savings account.

- Get Term Insurance to protect your family with high cover at low cost.

Earning ₹1L+ per month? (Focus: Diversification & Impact)

- Sophisticated Diversification: Beyond equities and crypto, explore debt funds, direct equities, and potentially real estate. Work with a fee-only financial planner to create a truly diversified portfolio aligned with your long-term goals.

- Automate Giving & Impact Investing: Set up monthly auto-debits for charitable donations. Additionally, explore ESG (Environmental, Social, Governance) funds or social impact bonds, especially if they align with your values.

- Mentor & Educate: Share your financial knowledge with someone you trust. Teaching someone else about money keeps you grounded, reinforces your own learning, and contributes positively to society. This isn’t just altruism; it’s a powerful way to solidify your own understanding and habits.

Money + Emotion : Why You Save Less Than You Should

Most people don’t save enough because it’s not just about numbers; it’s about feelings. We’re wired to seek comfort and avoid pain.

- The Escape Trap: We spend to escape boredom, stress, or unhappiness.

- The Worthiness Trap: We overspend to feel worthy, successful, or accepted by others.

- The Avoidance Trap: We avoid checking bank balances because it feels like a painful reminder of perceived “failure.”

What you need isn’t guilt. You need structure, self-awareness, and kindness. Save not as a punishment, but because it builds peace of mind, security, and future freedom. When an urge to overspend hits, pause. Ask: What emotion am I trying to satisfy? Is there a non-monetary way to address it? Consider keeping a simple spending diary to identify your emotional triggers.

You Don’t Need a Miracle Just a Mindful Method

Here’s the CrunchyFin philosophy:

“If you do the right thing with money 70% of the time, you’ll be 10x better off than 90% of people.”

Financial growth isn’t about perfection; it’s about consistent progress.

Start now. Transfer ₹20 today. Read one chart on an investment app. Open one free government social security scheme. Download one budgeting app. Talk to one friend about how you’re trying to change your money habits.

It won’t happen overnight. There will be setbacks. But yes it will work, if you apply these methods consistently and with self-compassion. We’re with you every small rupee, every smart click, every honest step towards financial freedom.