Corporate Bonds vs Fixed Deposits: Which One Is Better for You?

Investing your money wisely is crucial for building wealth and financial security. When it comes to safe and predictable investment options, corporate bonds and fixed deposits (FDs) are two popular choices. But which one is truly better for you? Let’s break it down in simple, practical terms so you can make an informed decision.

What Are Corporate Bonds?

Corporate bonds are debt securities issued by companies to raise capital. When you buy a corporate bond, you are essentially lending money to the company in exchange for fixed interest payments over a set period.

Key features of corporate bonds:

- Fixed interest rate (coupon) paid periodically

- Maturity period ranges from 1 to 10+ years

- Can be listed on stock exchanges, allowing some liquidity

- Risk depends on the company’s credit rating

Pros of Corporate Bonds:

- Higher interest rates compared to bank FDs

- Predictable income if held till maturity

- Potential for capital gains if bond prices rise

Cons of Corporate Bonds:

- Riskier than bank FDs (company may default)

- Prices may fluctuate if you sell before maturity

- Tax on interest income can reduce returns

What Are Fixed Deposits (FDs)?

Fixed deposits are bank deposits with a fixed tenure and interest rate. You deposit a lump sum amount for a certain period, and the bank pays you interest at regular intervals or at maturity.

Key features of FDs:

- Safe and low-risk investment backed by banks

- Tenure can range from 7 days to 10 years

- Interest rate fixed at the time of deposit

- Can be renewed or reinvested easily

Pros of FDs:

- Extremely safe and low risk

- Guaranteed returns, ideal for conservative investors

- Flexible tenures to match financial goals

Cons of FDs:

- Lower interest rates than corporate bonds

- Returns may not beat inflation over long term

- Penalties for premature withdrawal

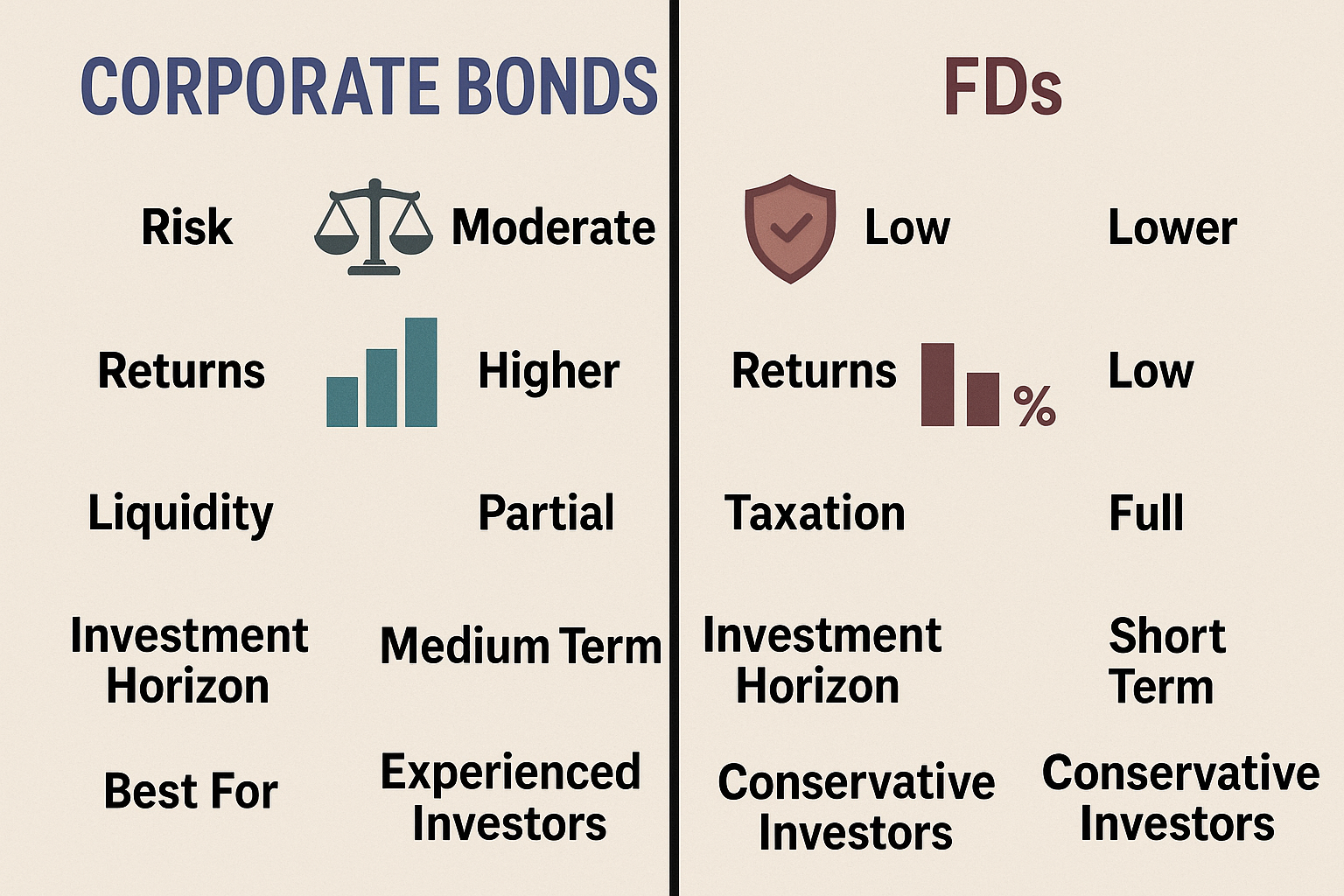

Comparing Corporate Bonds and Fixed Deposits

| Feature | Corporate Bonds | Fixed Deposits |

|---|---|---|

| Risk | Moderate to high (depends on issuer rating) | Low (bank-backed, insured up to ₹5 Lakh) |

| Returns | Higher interest rates (6–10% approx.) | Lower interest rates (4–7% approx.) |

| Liquidity | Can be sold in secondary market | Low; penalties for early withdrawal |

| Taxation | Interest taxed as per income slab | Interest taxed as per income slab |

| Investment Horizon | 1–10 years | 7 days–10 years |

| Best For | Investors seeking higher returns with moderate risk | Conservative investors seeking safe, predictable returns |

How to Decide Which One Is Right for You?

- Assess Your Risk Appetite

- If you are conservative and want guaranteed safety, FDs are better.

- If you can handle moderate risk for higher returns, corporate bonds are suitable.

- Investment Horizon

- Short-term (less than 3 years): FDs are safer.

- Medium to long-term (3+ years): Corporate bonds may yield better returns.

- Financial Goals

- FDs are ideal for emergency funds or fixed income needs.

- Corporate bonds work well for wealth-building and higher interest income.

- Diversification Strategy

- You can split investments between both to balance risk and return.

- Consider laddering bonds and FDs to manage liquidity and interest rate

Quick Tip for Beginners

Start by checking credit ratings of corporate bonds (AAA-rated are safest). For FDs, compare interest rates across banks and consider tax-saving FDs if applicable. Diversifying between both options can give stability plus better returns.

Final Verdict

There’s no one-size-fits-all answer. Corporate bonds offer higher returns but carry moderate risk, while fixed deposits are safer with lower, guaranteed returns. The best approach depends on your risk tolerance, financial goals, and investment horizon.

For beginners or young adults, a combination strategy keeping some money in FDs for safety and some in high-rated corporate bonds for growth often works best.

Key Takeaways

- FDs = low risk, low but guaranteed returns

- Corporate Bonds = moderate risk, higher potential returns

- Diversify to balance safety and growth

- Check ratings, interest rates, and maturity periods before investing