Building Your Financial Fortress: How to Link Insurance, Your Emergency Fund, and Investments

Ever wonder how to connect the dots between your insurance policies, that emergency cash stash, and your long-term investments? They aren’t isolated tools they are the three pillars of a secure financial plan.

Here’s a breakdown of how to connect these essential components to create a strong financial fortress that protects your wealth and secures your future.

1. The Foundation: Insurance as a Shield

Think of insurance as the initial protective layer. It’s the shield that stops a major financial disaster from wiping out your savings and investments.

- How it Protects Your Emergency Fund: Major unexpected costs like a critical illness, a large hospital bill, or a serious car accident shouldn’t drain your easily accessible cash.

- The Link: A robust Health Insurance policy pays for medical crises, and Term Life Insurance protects your family’s income if the worst happens to you. By having sufficient coverage, your emergency fund remains intact for non-insured events (like a job loss or home repair deductible).

- How it Protects Your Investments: Without insurance, a financial shock forces you to liquidate your long-term investments (like retirement funds or stocks) at a loss or at an inopportune time.

- The Link: Insurance, especially for catastrophic events, prevents you from dipping into your Investment Portfolio. This allows your investments to stay put, weather market fluctuations, and continue compounding toward your long-term goals (retirement, education, etc.).

2. The Buffer: The Emergency Fund

The emergency fund is your immediate financial shock absorber. It’s the cash you can access instantly without incurring debt or selling off assets.

- The Role: This fund is meant to cover smaller, non-insured emergencies or expenses while you wait for an insurance payout or find a new job.

- The Size: Financial experts typically recommend saving 3 to 6 months of essential living expenses (rent/EMI, groceries, utilities, and crucially, your insurance premiums).

- The Link to Insurance: When calculating your emergency fund target, make sure to factor in enough to cover your insurance premiums. This ensures that even if your income stops, your critical coverage stays active.

- Where to Keep It: In a highly liquid, low-risk account, such as a high-yield savings account, money market account, or a liquid mutual fund. The goal is safety and accessibility, not high returns.

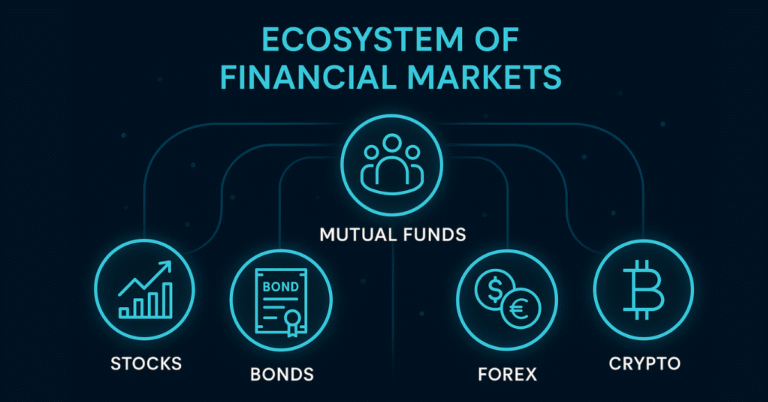

3. The Growth Engine: Investments

Once your shield (Insurance) is in place and your buffer (Emergency Fund) is full, you can confidently turn your attention to growing your wealth through investments.

- The Principle: Only invest money that you won’t need for the short term, as it gives your investments time to recover from market volatility.

- The Link to Emergency Fund & Insurance:

- Fund it First: You only shift your surplus savings into riskier, higher-growth investments (like equities or real estate) after your emergency fund is fully stocked and your essential insurance is purchased.

- Stay the Course: Because your emergency fund and insurance cover unexpected expenses, you are less likely to panic-sell your investments during a market downturn or a personal financial crisis, allowing them to deliver their maximum potential.

The 3-Step Financial Security Strategy

To create a cohesive plan, structure your financial priority in this order:

| Priority | Component | Action | Why it Works |

| #1 | Insurance (The Shield) | Secure essential coverage: Health, Term Life, Auto/Home. | Protects everything else from catastrophic loss. |

| #2 | Emergency Fund (The Buffer) | Save 3–6 months of living expenses in a liquid account. | Prevents disruption to investments and debt in smaller crises. |

| #3 | Investments (The Growth) | Direct surplus funds into diversified long-term vehicles (stocks, mutual funds, retirement accounts). | Maximises wealth creation because you don’t have to touch it during emergencies. |

By treating these three elements as a connected system, you’re not just saving and investing you’re building a truly secure financial future.