The Silent Giants: How Central Banks Masterfully Control the Price of Your Currency

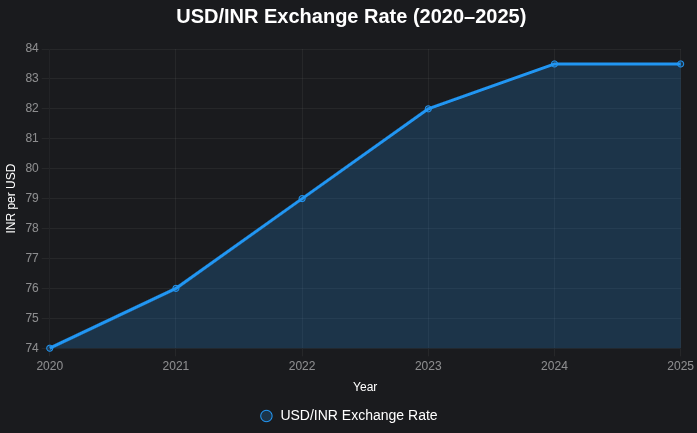

When you hear about the “Rupee falling” or the “Dollar strengthening,” it’s easy to dismiss it as random market noise. But the truth is, one of the biggest, most powerful players behind every major currency move is the Central Bank like the Reserve Bank of India (RBI), the Federal Reserve (U.S. Fed), or the European Central Bank (ECB).

These institutions are the guardians of a nation’s currency, and their decisions quietly (and sometimes loudly) move the entire global currency market. Understanding their levers is key to navigating the forex world, whether you’re an investor, traveler, or just a concerned citizen.

1. The Central Bank’s Role: More Than Just a Bank

Central banks have a core mandate: to keep the economy stable. This includes controlling inflation, supporting growth, and managing the money supply.

Every single policy action they take from a simple press release to a major rate hike sends powerful waves through the Forex (Foreign Exchange) market, dictating the relative value of your currency against others.

2. The Most Powerful Lever: Interest Rates

This is the central bank’s primary tool for currency manipulation. Interest rates represent the cost of borrowing and the return on savings in a country.

- When a central bank raises interest rates (Hawkish Stance):

- It makes that country’s currency (e.g., the Indian Rupee, INR) more attractive to global investors seeking higher returns.

- Demand for the currency increases as foreign capital flows in to buy domestic assets (bonds, deposits).

- Result: Strong Currency ↑.

- When a central bank cuts interest rates (Dovish Stance):

- The currency becomes less attractive, causing investors to pull their capital out and seek better returns elsewhere.

- Result: Weak Currency ↓.

| Policy Action | Effect on Interest Rate | Effect on Currency Demand | Effect on Currency Value |

| Hike | ↑ | ↑ | Strengthens |

| Cut | ↓ | ↓ | Weakens |

3. The Supply Side: Money Printing (Quantitative Easing)

This policy, often used during recessions or crises, involves the central bank creating new money to buy government bonds or other assets, injecting liquidity into the system.

- Action: The supply of the domestic currency increases dramatically.

- Economic Risk: More money chasing the same amount of goods increases the risk of inflation and diminishes the currency’s purchasing power.

- Forex Effect: This typically weakens the currency’s value, as global investors prefer holding assets (like gold or foreign currencies) that aren’t being rapidly devalued by excessive supply.

For example, when the U.S. Federal Reserve printed trillions during COVID-19 to support the economy, concerns over an inflated money supply led to temporary dollar weakness.

4. Direct Action: Forex Market Intervention

Central banks don’t always rely on indirect tools like interest rates; they can intervene directly in the forex market to stabilize their currency.

- To Support a Weakening Currency (e.g., Rupee): The RBI will sell its reserves of foreign currencies (like U.S. Dollars) and buy its own currency (Rupees). This artificial demand prevents a freefall.

- To Limit an Overly Strong Currency: The central bank will sell its own currency and buy foreign assets. This increases the domestic currency’s supply, making it cheaper and boosting exports.

This ensures orderly markets and helps keep crucial metrics like import prices and inflation under control.

5. The Power of Words: Economic Outlook & Announcements

Sometimes, a central bank doesn’t even need to change policy; a single statement from the Governor is enough to move markets.

- “Hawkish” language (hints at future interest rate hikes) signals a tighter money supply → traders immediately anticipate a stronger currency → the currency rises before the actual policy change.

- “Dovish” language (hints at future rate cuts or easier policy) signals the opposite.

This anticipatory trading based on forward guidance shows the immense influence central banks hold through communication alone.

The Global Chain Reaction

Forex is a global balancing act. A decision by one central bank can have a ripple effect worldwide, particularly on emerging markets (EM).

- If the U.S. Fed raises rates aggressively, global investors might shift capital out of riskier EM assets (like Indian bonds) and into higher-yielding, safer U.S. assets.

- This capital outflow puts severe downward pressure on currencies like the Rupee, demonstrating how globally connected the central bank ecosystem truly is.

Key Takeaway for Investors

Central banks don’t just control money; they shape the financial destiny of nations through every policy, interest rate announcement, and press statement. For traders and long-term investors, understanding the central bank’s mandate and anticipating its next move is the single most critical factor in reading the forex market’s “weather report” correctly.