SIP vs Lump Sum: Which Investment Strategy Wins in 2025?

So, you’re ready to invest, but there’s a big question: Should you go with a Systematic Investment Plan (SIP) or a Lump Sum investment? Both have their fans, and both can work wonders depending on your situation. In this beginner-friendly guide, we’ll break down SIP vs Lump Sum, dive into their pros, cons, and real-world examples, and help you decide what’s best for 2025. Let’s make investing simple, human-first, and CrunchyFin style!

What Are SIP and Lump Sum?

- SIP (Systematic Investment Plan): Think of it like a monthly gym membership for your money. You invest a fixed amount (say, ₹5,000) regularly into a mutual fund. It’s automated, disciplined, and builds wealth over time.

- Lump Sum Investment: This is like betting big at a casino table. You invest a large chunk of money (like a bonus or savings) all at once into a fund.

Both can grow your wealth, but they take different paths with unique risks and rewards. Let’s explore.

How SIP Works: Why It’s a Crowd Favorite

SIP is like the steady tortoise in the investing race—slow, consistent, and reliable. Here’s why it’s so popular in India:

Advantages of SIP

- Rupee Cost Averaging: SIP lets you buy more mutual fund units when prices are low and fewer when prices are high. This averages out your cost over time, reducing the risk of investing at a market peak.

- Discipline & Habit: It’s like auto-saving for your future. Even during market swings, your monthly SIP keeps you on track.

- Beginner-Friendly: You can start with as little as ₹500/month, no need to time the market, and gradually build wealth.

- Proven Returns: Data from 2025 shows many equity mutual funds in India delivered 10-12% XIRR for SIP investors over 7-10 years (Source: The Economic Times).

When SIP Shines

- You have a regular income and want to spread out risk.

- You’re new to investing or cautious about market ups and downs.

- Markets are volatile (like in 2025), and you want to avoid emotional investing mistakes.

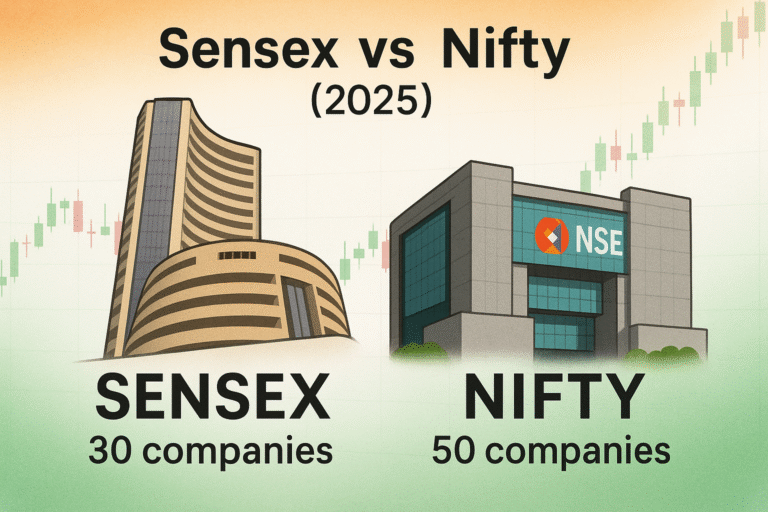

Example: Priya invests ₹10,000 monthly in a Nifty 50 index fund via SIP. In 2020, when Nifty was at 12,000, she started. By Sept 2025, with Nifty at ~22,500, her investment grows to ~₹8.5 lakh, with an XIRR of ~14% (before taxes). Steady wins!

How Lump Sum Works: High Risk, High Reward

Lump Sum is the hare in the race fast and bold, but it needs careful timing. Here’s the deal:

Advantages of Lump Sum

- Full Market Exposure: Your entire investment starts working from day one, benefiting from market growth and compounding early.

- Bull Market Power: If you invest when valuations are low (say, after a correction), lump sum can outperform SIP. For example, investing during a 2020 dip would’ve yielded ~15-18% CAGR by 2025 (Source: The Financial Express).

- Faster Compounding: Since all your money is in the market from the start, gains compound quicker.

Risks of Lump Sum

- Volatility Risk: Invest at a market peak, and you could face steep losses initially (e.g., 2008 or 2020 crashes).

- Timing Dependency: Success hinges on entering at the right time, which even pros struggle with.

- Emotional Stress: Big market swings can make you second-guess your decision.

When Lump Sum Makes Sense

- You have a large cash pile (bonus, inheritance, savings) ready to invest.

- You believe the market is undervalued or poised for a rally.

- You’re comfortable with short-term volatility for long-term gains.

Example: Raj gets a ₹5 lakh bonus in 2023 and invests it in a flexi-cap fund when the market dips. By Sept 2025, his investment grows to ~₹7.2 lakh, with a ~20% CAGR, beating Priya’s SIP returns because he timed it well.

SIP vs Lump Sum: 2025 Data & Insights

Here’s what recent trends and studies tell us about India’s market in 2025:

- SIP Consistency: Over 10 years, SIPs in large-cap and flexi-cap funds often delivered slightly better CAGR (10-12%) than lump sum due to rupee cost averaging, especially when markets were choppy (Source: The Financial Express).

- Lump Sum in Bull Runs: In steady bull markets (like 2021-2023), lump sum investments at the right time outperformed SIPs by 2-4% CAGR (Source: Stable Money App).

- SIP Popularity: SIP inflows hit record highs in 2025, with over ₹20,000 crore monthly contributions, showing investor trust in steady investing (Source: The Economic Times).

SIP vs Lump Sum: Head-to-Head

| Feature | SIP | Lump Sum |

|---|---|---|

| Investment Style | Regular, small amounts | One-time, large amount |

| Risk Level | Lower (spreads risk) | Higher (market timing matters) |

| Best for | Beginners, regular income | Experienced, large cash reserves |

| Market Condition | Volatile or uncertain markets | Undervalued or rising markets |

| Emotional Ease | Less stressful, automated | Can be nerve-wracking |

How to Choose in 2025: A Practical Guide

Not sure which strategy fits you? Here’s a quick framework:

| Situation | Best Strategy |

|---|---|

| Regular income, limited cash | SIP |

| Large cash pile, market undervalued | Lump Sum (or staggered Lump Sum) |

| Want to spread risk | SIP + occasional Lump Sum |

| Short-term goal (1-3 years) | SIP or wait for better timing |

Pro Tip: The Hybrid Approach

Combine both! Use SIP for steady, long-term growth (e.g., ₹5,000/month in a Nifty 50 fund). If you get a windfall (like a ₹2 lakh bonus), invest part as a lump sum in tranches (e.g., ₹50,000 every few months) to balance risk and reward.

Final Take: What Wins in 2025?

There’s no universal winner it depends on you. But here’s the 2025 vibe:

- SIP is safer, beginner-friendly, and perfect for India’s volatile markets. It’s like a steady drip building a bucket of wealth.

- Lump Sum can deliver bigger wins if you time it right, but it’s riskier like a one-shot rocket launch.

- Hybrid Strategy: For most investors, blending SIP’s discipline with occasional lump sum investments is the smartest play.

At CrunchyFin, we believe investing should be clear, consistent, and tailored to your life. SIPs offer stability and peace of mind. Lump sums bring power but demand timing. Pick what aligns with your goals, risk comfort, and market outlook and stick with it.