Tax-Free Bonds in 2025: Your Definitive Guide to Investing (The Real Story)

The Big Question: Should You Invest in Tax-Free Bonds in India in 2025?

Tax-Free Bonds. The name itself sounds like a financial dream: guaranteed, safe, fixed income with zero tax liability.

But here’s the critical, real-time detail you need to know: No new primary issues of the popular Section 10(15) Tax-Free Bonds have been launched by the Government of India for general infrastructure funding since 2016.

So, if you want to invest today in 2025, you are essentially looking at the Secondary Market. This changes the investment game entirely.

Let’s break down the true meaning, the major benefits, and the realistic process of investing in these bonds today.

1. What Exactly are Tax-Free Bonds?

Tax-Free Bonds are debt instruments issued by Government-backed Public Sector Undertakings (PSUs) to raise funds for massive infrastructure and development projects (highways, power, railways).

- The Key Benefit (Section 10(15)): The most significant feature is that the entire interest income earned from these bonds is completely exempt from Income Tax under Section 10(15) of the Income Tax Act, 1961. This applies regardless of your tax slab.

- Issuers: Past and current issuers include high-credit-rated entities like NHAI, IRFC, PFC, REC, and HUDCO.

- Safety: Since they are issued by Government-backed entities, they carry the highest credit ratings (typically AAA), meaning the risk of default is virtually zero.

- Tenure: They are long-term instruments, typically maturing in 10, 15, or 20 years.

2. Why Are These Bonds a Must-Have for High-Income Earners?

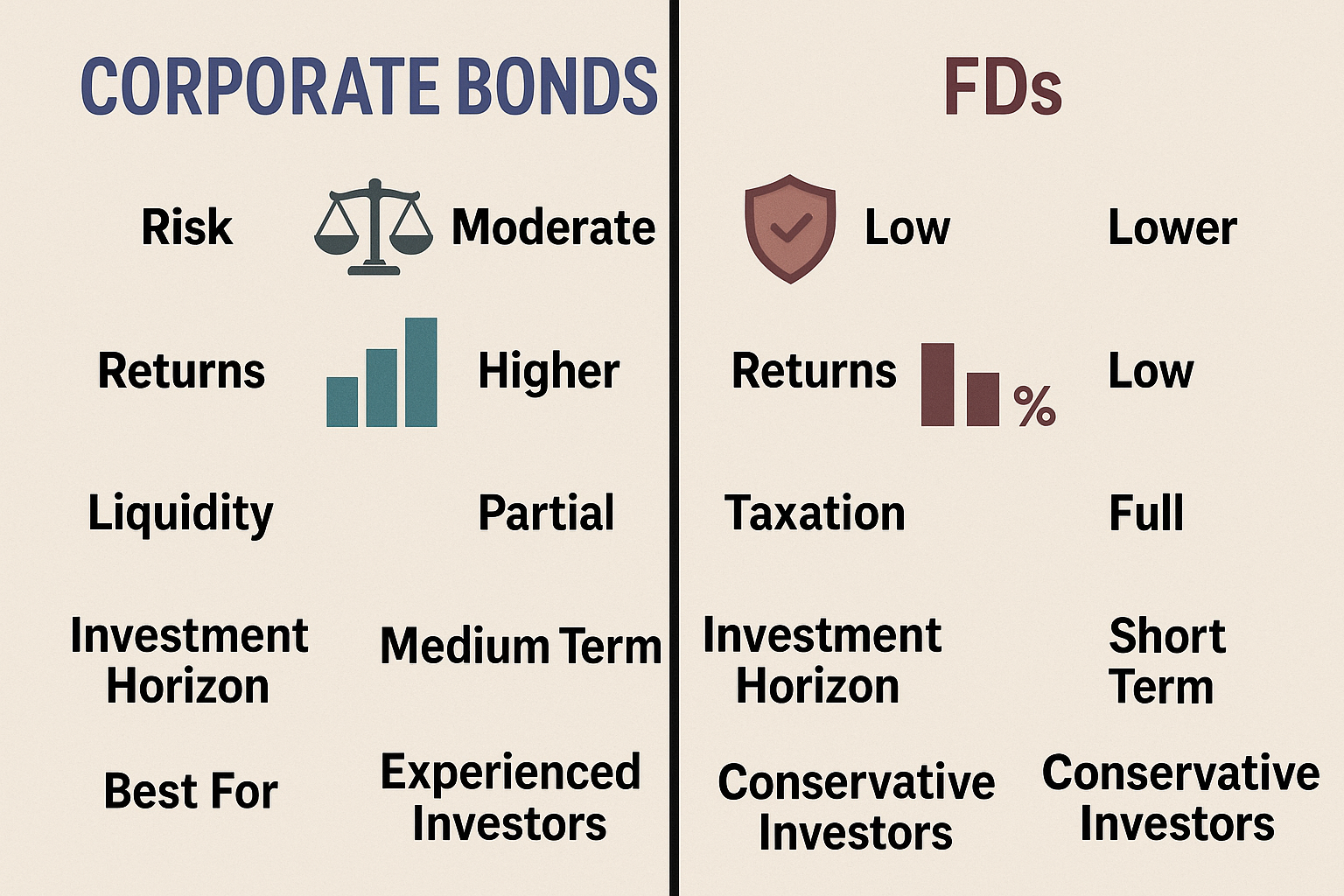

While the nominal interest rate on these bonds (historically between 5.5% and 7.5%) might seem lower than a Fixed Deposit (FD), the Post-Tax Yield is where they shine.

| Investment | Nominal Rate (Example) | Tax Deduction (30% Slab) | Effective Post-Tax Return |

| Tax-Free Bond | 6.0% | 0% | 6.0% |

| Fixed Deposit | 7.5% | 30% of interest | 5.25% |

Conclusion: If you fall into the 20% or 30% tax bracket, your effective return from a Tax-Free Bond is likely higher than almost any taxable fixed-income instrument.

3. The Reality of Investing in Tax-Free Bonds in 2025

Since new primary issues for general investors are largely unavailable, you must use the secondary market.

How You Invest Today (Secondary Market)

- Demat Account is Mandatory: You must have an active Demat and Trading account with a broker (Zerodha, Groww, etc.).

- Trading on Exchanges: You buy the bonds directly on the NSE or BSE, just like you would buy a share.

- Price Volatility: Unlike a primary issue, the price of these bonds on the secondary market fluctuates based on two key factors:

- Market Interest Rates: If current interest rates are lower than the bond’s fixed coupon rate, the bond’s market price will trade above face value (at a premium).

- Demand: Due to their scarcity and tax benefits, demand is always high, keeping prices buoyant.

The Critical Secondary Market Factor: Yield to Maturity (YTM)

When buying a bond at a premium in the secondary market, the true return you get if you hold it until maturity is the Yield to Maturity (YTM), not the original coupon rate.

- You must check the YTM before buying, as paying too high a premium can lower your effective return significantly.

4. Tax-Free vs. Tax-Saving: Do Not Get Confused in 2025!

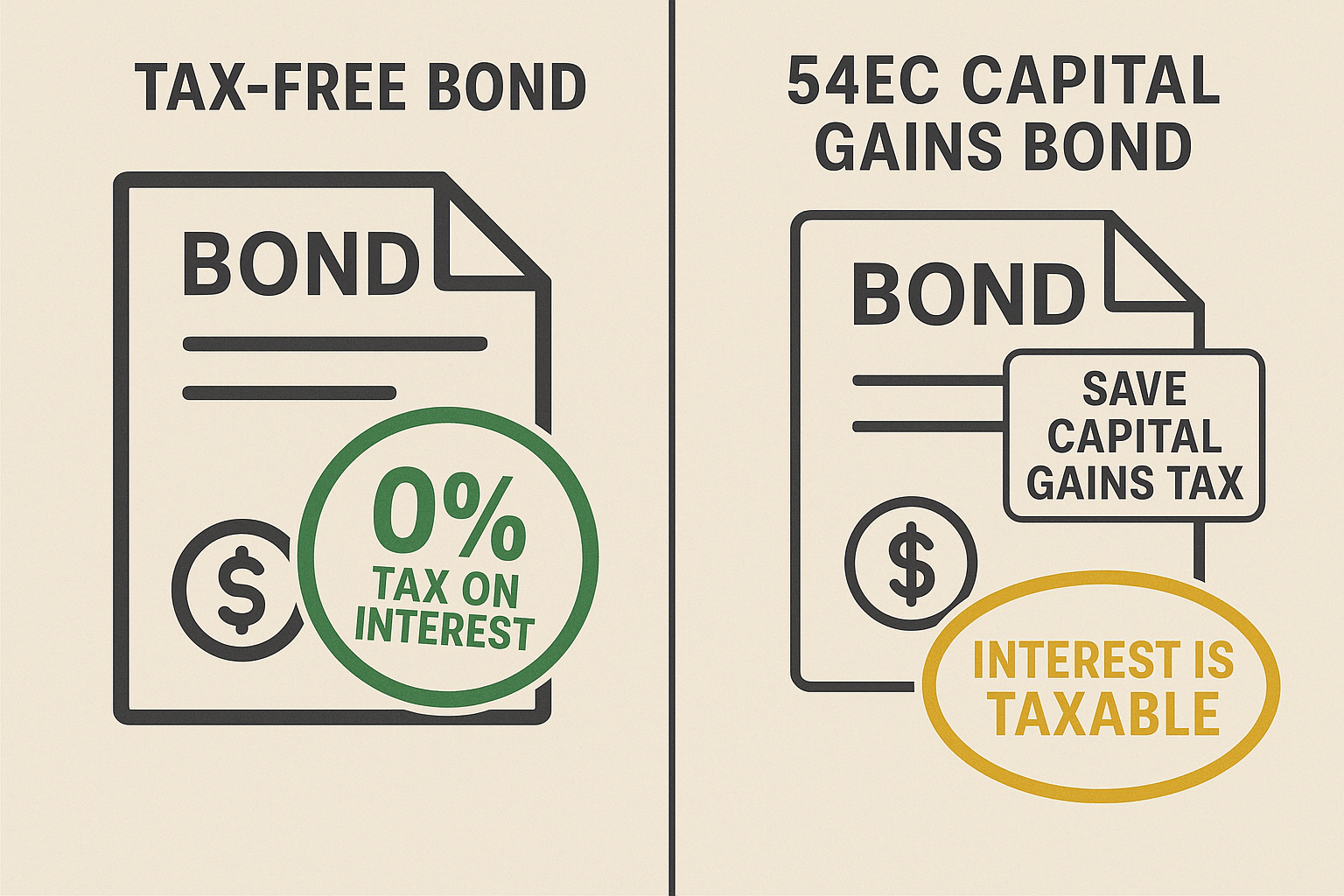

A common mistake is confusing Tax-Free Bonds with Capital Gains Bonds (54EC Bonds).

| Feature | Tax-Free Bonds (Sec 10(15)) | 54EC Capital Gains Bonds (REC, IRFC, PFC) |

| Tax Benefit | Interest is 100% Tax-Free | Used to save tax on Long-Term Capital Gains from property sale. |

| Interest Income | Tax-Free | Interest is TAXABLE as per your slab. |

| Investment Goal | Long-term, safe, tax-free income stream. | Avoid large, immediate tax on property sales. |

| Availability | Only in Secondary Market (old issues). | Currently available (primary market). |

Real-Time Tip for 2025: If you have booked a large long-term capital gain from selling a house or land, the 54EC Bonds (e.g., REC or IRFC) are your tool (up to ₹50 Lakhs investment). If you want an annual, tax-free income stream, you need the Section 10(15) Tax-Free Bonds from the secondary market.

5. Is a Tax-Free Bond Investment Right for You?

Tax-Free Bonds are not for everyone.

| Invest If You… | Avoid If You… |

| Are in the 20% or 30% Tax Bracket. (This is the ideal target audience.) | Are in the 0-10% Tax Bracket. (The low nominal rate won’t justify the lock-in.) |

| Need an ultra-safe, stable income. (Default risk is negligible.) | Need liquidity soon. (The secondary market can be illiquid at times, and selling early may lead to a capital loss.) |

| Have a long-term goal (10+ years). | Want tax deduction on principal. (There is no 80C or 80CCF deduction on these bonds.) |

| Have funds parked in low-yielding FDs. | Cannot tolerate capital gains tax. (Selling the bond for profit in the secondary market incurs capital gains tax.) |

Final Verdict for 2025:

Tax-Free Bonds remain an invaluable asset for individuals in the higher tax slabs, offering a unique blend of safety and tax efficiency. They are best treated as a Buy-and-Hold-to-Maturity instrument for securing a predictable, tax-free income stream for the long run.

Always calculate the current YTM before purchasing on the secondary market.