How Do Taxes Work in India? Where Does the Money Go in 2025

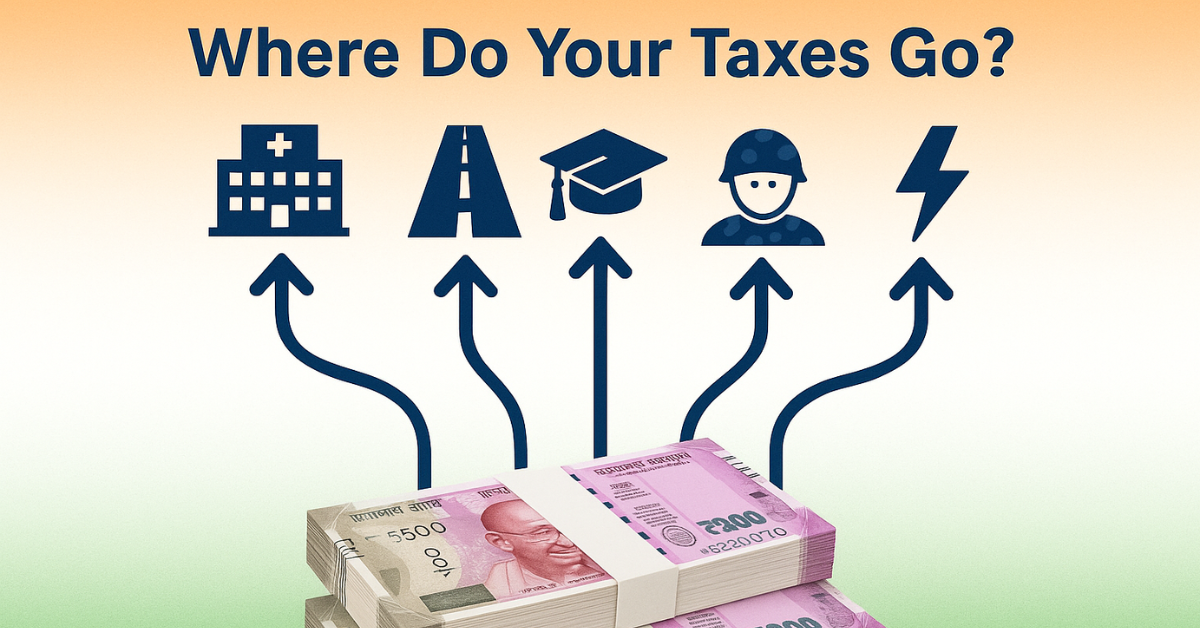

Every time you receive your salary, buy groceries, or even pay for that chai at your favourite stall, taxes quietly take a slice. It might feel like your money vanishes but somewhere, it’s supposed to build something bigger: roads, hospitals, jobs, schools, defence, and much more. In 2025, understanding how taxes work in India and where that money actually goes isn’t just useful it’s essential. Let’s break it down, without the jargon, so you see the full picture.

What Taxes Do in India — The Basics

When you hear “tax,” think of it as a collective pool. You, your neighbour, your friend—everyone contributes. The government then uses this pool to run the country.

There are two broad kinds of taxes:

- Direct Taxes: These are taken straight from your income or your business’s profits—like income tax or corporate tax. When your salary crosses a certain limit, you pay some percentage to the government.

- Indirect Taxes: These are embedded in the things you buy the clothes, phone, grocery, fuel, etc. Taxes like GST (Goods & Services Tax), customs duty, or excise duty. You don’t directly see them taken out, but they’re there in the price you pay.

The government also earns from non-tax sources (like fees, interest, etc.), but taxes make up the lion’s share.

In FY 2024-25, India’s total receipts (excluding borrowings) were estimated at about ₹47.66 lakh crore. Of this, gross tax revenue was around ₹38.31 lakh crore. Moneycontrol

How Much India Collects (and Spends)

Let’s zoom in on how much tax the government expects, and how much it spends:

- The fiscal deficit (the gap between what the government earns vs spends) for 2025-26 is projected around 4.4% of GDP, slightly lower than the previous year. Business Standard

- The government’s total expenditure for the year is budgeted around ₹50.65 lakh crore. Business Standard

- Of this, a large share goes into paying interest on past loans this is debt service. It’s estimated at roughly ₹12.76 lakh crore, which comes to about 25% of total government spending. Reddit+2Reddit+2

What does that mean? Even before building new things or hiring, a quarter of what the government spends goes merely to service its past debts.

Where the Tax Money Goes — The Big Items

Here are the main “buckets” where tax money is spent (with percentages where available) in 2025:

- Defence: India has allocated ₹6.81 lakh crore to the Defence Ministry for FY 2025-26, the biggest among all ministries. That’s about 13.45% of the total budget. Uni India+2The Week+2

- Subsidies: The government spends billions on food, fertilizer, and fuel subsidies. For FY 2025-26, a little over ₹4.26 lakh crore is earmarked for these subsidies. The New Indian Express+1

- Pensions & Salaries: Central government employee salaries, allowances, and pensions also take up a chunk. The New Indian Express+2Moneycontrol+2

- Infrastructure & Capital Expenditure: To grow and maintain the physical backbone (roads, railways, bridges, public buildings), the government has set aside ₹11.21 lakh crore for capital expenditure in FY26. Business Standard+1

- Health, Education & Social Welfare: While percentages are smaller compared to defence or interest payments, funds go into healthcare schemes (public hospitals, health insurance programmes), school education, and welfare schemes. For example, the Ministry of Health & Family Welfare’s allocation is about ₹99,858 crore, which is roughly 1.97% of total government expenditure. Wikipedia

Why It Sometimes Feels Like Your Tax Money Isn’t Doing Much

Even though government spends on big things, people often feel the benefits don’t reach them. Why?

First, interest payments eat up a huge slice of the budget. This means less for new projects. If you imagine earning a salary, and most of it goes only to paying past debts, there’s little left to spend on savings, improvements, or growth.

Second, many public services (hospitals, roads, schools) are underfunded or have quality issues. Just because money is allocated doesn’t guarantee flawless execution. Bureaucracy, delays, inefficiencies, and corruption can slow things down.

Third, there are state vs central gaps: the central government collects many taxes but states often implement services. If state government infrastructure is weak or neglected, everyday life doesn’t improve fast.

Why We Still Need to Pay Taxes (Even Though It’s Frustrating)

Yes, taxes are a burden. But they’re also the engine that powers the country. Without them, there’d be no public hospitals, no defence forces, no public roads, no law enforcement, and many social welfare schemes would vanish.

In 2025, as India continues to grow, urbanize, and invest in modern sectors like tech and healthcare, tax money is essential for:

- Building new infrastructure to connect cities and rural areas.

- Investing in healthcare and fighting public health crises.

- Ensuring national security in a changing global landscape.

- Supporting social safety nets (food, livelihood, schemes for poor).

Final Thoughts

When you send in your taxes be it income tax, GST, or any other kind know this: your money goes into big responsibilities. Sometimes, the visible change is slow. But things are happening: defence modernization, subsidy distributions, infrastructure expansions, and more.

Still, we all have a part to play: demanding better accountability, supporting transparency, and choosing representatives who commit to using tax money well. Because tax isn’t just about what you give it’s about what you expect in return.

At CrunchyFin, we believe in understanding finance so it empowers you. Pay taxes, yes but also stay informed, stay critical, and hold your system accountable.