Ultimate Health Insurance Guide in India 2025: Plans, Benefits & How to Choose

In 2025, safeguarding your health and finances is more critical than ever. With rising medical costs in India, health insurance has become a necessity, not a luxury. Whether you’re exploring health insurance plans, seeking affordable health insurance, or considering private medical insurance, this comprehensive guide will help you navigate the complex world of insurance. We’ll cover everything from types of plans to actionable tips for choosing the best medical insurance for you and your family, ensuring you make an informed decision to secure your future.

What is Health Insurance?

Health insurance is a financial product that covers medical expenses, such as hospitalization, surgeries, and doctor consultations, ensuring you don’t face a financial burden during health emergencies. Unlike medical insurance, which may focus on specific treatments or services, health insurance offers broader coverage, including preventive care and wellness benefits.

Why It Matters in India Today

- Rising Medical Costs: Hospitalization costs in India can range from ₹50,000 to ₹5 lakh, depending on the treatment and city.

- Unpredictable Health Risks: Lifestyle diseases like diabetes and heart conditions are on the rise, making critical illness cover essential.

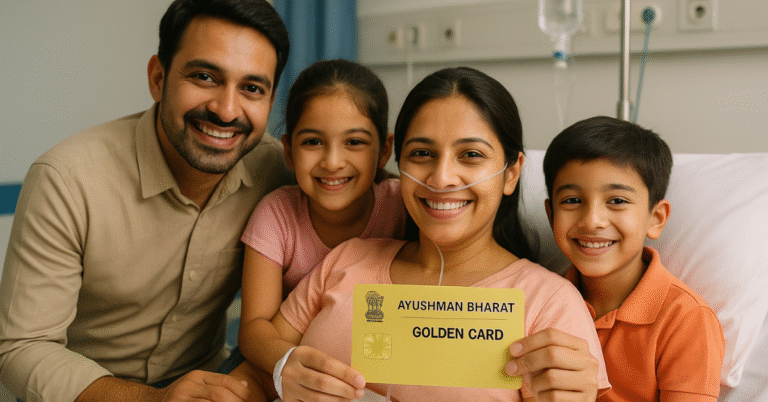

- Government Support: Schemes like Ayushman Bharat provide basic coverage, but private health insurance offers more comprehensive benefits and flexibility.

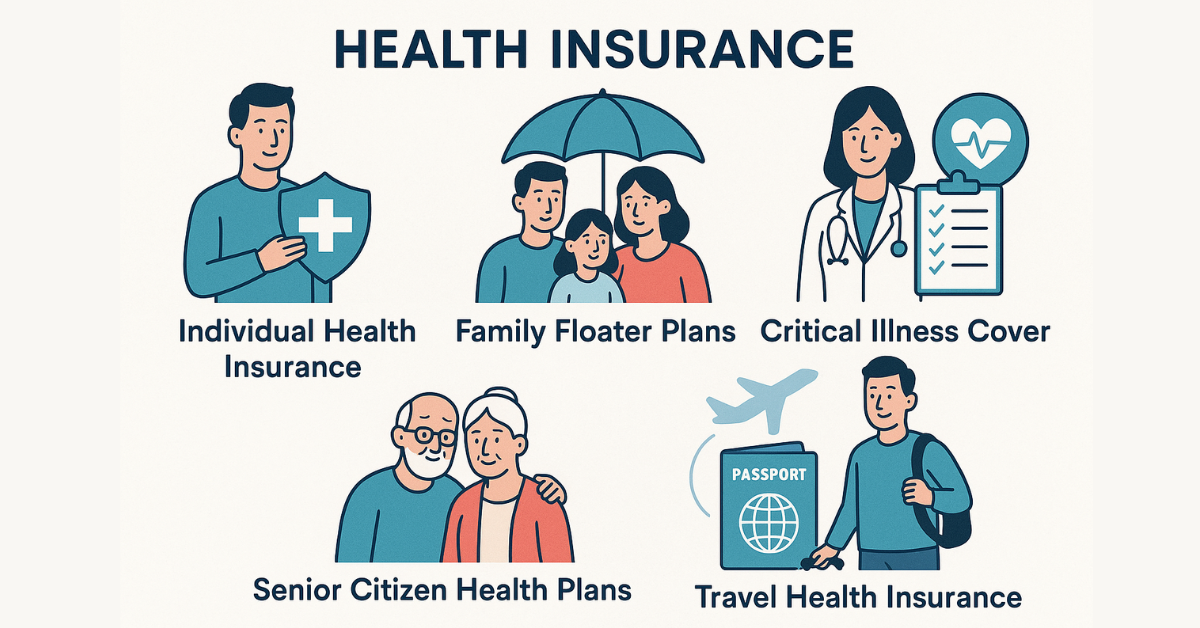

Types of Health Insurance Plans in India

Choosing the right health insurance plan depends on your needs, family size, and budget. Here’s a breakdown of the most popular types available in 2025:

1. Individual Health Insurance

- What it is: Covers a single person, tailored to individual health needs.

- Best for: Young professionals, singles, or those seeking personalized coverage.

- Key Benefit: Focused coverage with flexible premium options.

2. Family Floater Plans

- What it is: A single policy covering the entire family under one premium.

- Best for: Families with children or dependent parents.

- Key Benefit: Cost-effective compared to multiple individual plans.

3. Critical Illness Cover

- What it is: Provides a lump-sum payout for serious illnesses like cancer, heart attack, or stroke.

- Best for: Individuals with a family history of critical illnesses.

- Key Benefit: Financial support for expensive treatments and recovery.

4. Senior Citizen Health Plans

- What it is: Designed for individuals aged 60+ with tailored benefits.

- Best for: Parents or grandparents needing specialized care.

- Key Benefit: Covers age-related ailments and offers higher sum insured.

5. Travel Health Insurance

- What it is: Protects against medical emergencies during domestic or international travel.

- Best for: Frequent travelers or those planning international trips.

- Key Benefit: Covers unexpected medical costs abroad or within India.

How to Choose the Right Health Insurance Plan

Selecting the best health insurance plan requires balancing coverage, cost, and provider reliability. Follow these steps to make an informed choice:

- Evaluate Coverage vs. Premium

- Ensure the sum insured (e.g., ₹5 lakh–₹50 lakh) aligns with your medical needs.

- Compare premiums across providers to find affordable health insurance without compromising coverage.

- Check Network Hospitals & Cashless Facility

- Opt for insurers with a wide network of hospitals offering cashless treatment.

- Example: Providers like Star Health and ICICI Lombard have 10,000+ network hospitals in India.

- Understand Co-Pay, Deductibles, and Exclusions

- Co-pay: A percentage of the bill you pay out-of-pocket (common in senior citizen health plans).

- Deductibles: Fixed amount you pay before insurance kicks in.

- Exclusions: Check for treatments not covered, like cosmetic procedures or pre-existing conditions with waiting periods.

- Compare Multiple Plans

- Use online platforms to get health insurance quotes and compare features.

- Look for policies with no-claim bonuses, wellness benefits, and flexible renewal options.

- Leverage Government Schemes

- Explore schemes like Ayushman Bharat for low-income families or state-specific programs for additional coverage.

Top Tips to Save Money on Health Insurance

Maximizing value from your health insurance doesn’t mean compromising on coverage. Here are practical tips to save money in 2025:

- Opt for a Higher Deductible

- If you’re healthy, choose a higher deductible to lower your premium costs.

- Example: A ₹10,000 deductible can reduce premiums by up to 20%.

- Choose Family Floater Plans

- Instead of individual plans, opt for a family floater plan to cover multiple members under one policy, saving 10–30% on premiums.

- Look for Annual Wellness Benefits

- Many insurers offer free health check-ups or discounts on gym memberships, adding value to your plan.

- Review and Renew Regularly

- Reassess your policy annually to ensure it meets your current needs and includes the latest benefits.

- Take Advantage of Tax Benefits

- Under Section 80D, premiums paid for health insurance are tax-deductible up to ₹25,000 (₹50,000 for senior citizens).

Frequently Asked Questions (FAQ)

What is the difference between health insurance and critical illness cover?

Health insurance covers a wide range of medical expenses, including hospitalization and routine care, while critical illness cover provides a lump-sum payout for specific serious illnesses like cancer or stroke. Combining both offers comprehensive protection.

Can I claim insurance for pre-existing conditions?

Yes, but most policies have a waiting period of 1–4 years for pre-existing conditions. Always disclose these conditions when purchasing to avoid claim rejections.

How do I get health insurance quotes online?

Visit insurer websites or comparison platforms like Policybazaar or Coverfox. Enter details like age, coverage needs, and family size to get instant health insurance quotes.

Is travel health insurance necessary for domestic trips?

While not mandatory, travel health insurance is recommended for domestic trips to cover emergencies, especially in areas with limited access to network hospitals.

Conclusion

Health insurance is your shield against unpredictable medical expenses, offering peace of mind for you and your loved ones. Whether you’re exploring private medical insurance, family floater plans, or critical illness cover, choosing the right policy in 2025 starts with understanding your needs and comparing options. Use this guide to find affordable health insurance that fits your budget and protects your future. Start small, choose wisely, and make health a priority today!