AI Crypto and Daily Saving Habits: The Real-World Guide to Smart Money in 2025

We keep hearing about AI and crypto everywhere. Some people call them “buzzwords,” while others believe they are the future of money. But here’s the truth: both are already shaping how we save, invest, and spend in 2025.

This isn’t about hype. It’s about understanding how artificial intelligence and cryptocurrency quietly affect your daily financial life and what you can do to stay ahead.

1. AI is Already Managing Your Money (Even If You Don’t Know It)

- When you use a payment app, AI detects fraud in real-time.

- Your bank uses AI to decide loan approvals and interest rates.

- Stock trading? Most of it is driven by AI-powered algorithms.

In short: AI is your invisible financial advisor, even if you never hired one.

2. Crypto is More Than Just Bitcoin

Most people think of crypto as risky coins. But in reality:

- Crypto is changing cross-border payments, making them faster and cheaper.

- Many businesses now accept crypto as direct payments.

- Governments are exploring CBDCs (Central Bank Digital Currencies) crypto-inspired digital rupees and dollars.

The real disruption? Crypto is quietly replacing traditional rails like SWIFT and Visa.

3. The AI + Crypto Power Combo

Now, imagine AI managing crypto:

- AI bots predicting crypto price moves.

- Smart contracts using AI to make instant, fair financial decisions.

- Personalized AI advisors helping you invest in crypto safely.

This synergy could create a new financial system where decisions are faster, smarter, and more transparent.

4. What This Means for YOU (Not Just Big Players)

Most blogs stop at theory. But here’s how it touches your daily life:

- Faster loans: AI + blockchain = instant credit approvals.

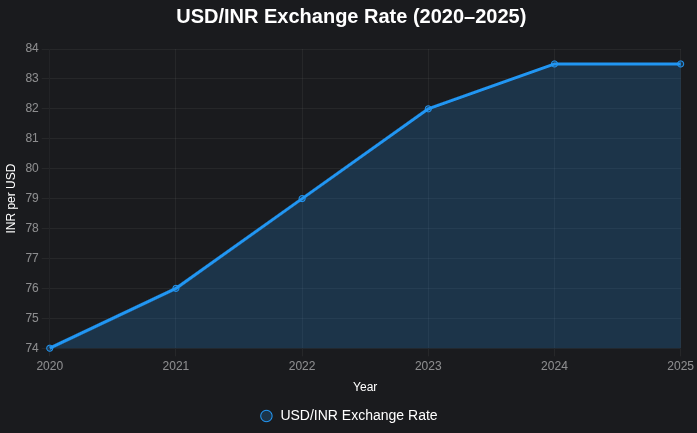

- Cheaper remittance: Sending ₹10,000 abroad could cost ₹10, not ₹1,000.

- Smarter savings: AI tools can suggest the best crypto + traditional mix for your goals.

5. Should You Invest in AI + Crypto? (The Real Talk)

Let’s be honest: not everyone should jump in.

- AI tools are reliable, but they still depend on your financial discipline.

- Crypto can grow your money but it’s also volatile and risky.

- A smart approach is to start small, like investing 2–5% of your portfolio.

Rule: Use AI to learn. Use crypto carefully. Don’t bet your future on hype.

Conclusion: The Future Is Hybrid

The future isn’t “AI vs. Crypto” or “Banks vs. Bitcoin.”

It’s a hybrid system traditional finance, AI, and crypto working together.

Those who learn, adapt, and act early will benefit the most.

Those who ignore it may find themselves left behind.

So ask yourself: Are you ready for the AI + Crypto financial revolution?