The ‘Child Rule’: How Thinking Like a Kid Can End Your Money Worries

Ever feel like your money vanishes faster than ice cream on a hot day? Do your savings goals crumble before they even begin? If you’re tired of the constant worry and endless financial juggling, you’re not alone. Most of us have been there, watching our peace quietly erode under the weight of money stress.

The truth is, managing money doesn’t have to be complicated.

You don’t need to be a finance expert or have a big income. You just need a simple plan and a clear reason to follow it. And sometimes, the best lessons don’t come from books or experts they come from children.

Welcome to “The Child Rule.”

It’s a peaceful, easy way to manage your money at any income. It’s based on how a child saves with clear goals, small sacrifices, and joyful focus. This isn’t about being strict. It’s about thinking like a child again simple, honest, and determined.

The Child Rule Mantra:

“Set a goal. Think like a child. Control the cravings. Save with joy. Crunch the target. BINGO!”

How the Child Rule Was Born: A Story of a ₹300 Game

Let me tell you about a 14-year-old, let’s call him Rohan. Rohan desperately wanted the latest video game, costing ₹300. His monthly allowance was ₹100. Most kids might just ask their parents, but Rohan, with his growing brain and clear desire, decided to make a plan. He wouldn’t just ask; he’d earn it.

He thought, “Okay, I get ₹100 every month. If I spend less on candy, I can save up!”

- Month 1: He was careful. Instead of spending ₹50 on candy, he spent only ₹30, saving a good ₹70 in his little piggy bank. He felt a spark of achievement!

- Month 2: He saw a new snack in the market, a big temptation! But he remembered his game. He tried it, spent ₹20, and still managed to put ₹60 aside. Now he had ₹130 saved!

- Month 3: He stayed focused. Another ₹70 went into the piggy bank. His savings were now at ₹200. His Dad, seeing his dedication, even gave him a bonus ₹10. So close!

- Month 4: Rohan was on fire! He knew this was the month. He spent very little on treats, maybe just ₹10 for a celebratory candy, and put the rest, ₹90, straight into savings.

BINGO! He had ₹300, enough for his game! That feeling of buying it with his own saved money was priceless. Rohan’s parents were amazed. He didn’t just get the game; he learned the power of planning, patience, and making conscious choices.

Scaling Up: From Games to Gadgets & Trips

Now, imagine the same dedication in a slightly older kid. Meet Priya, a 17-year-old college student who gets ₹1000 every month as pocket money. She had a simple dream: to go on a trip with her friends during semester break. A proper college memory bus journey, shared hotel room, local food, some shopping, and lots of fun. But it wasn’t cheap.

When she asked around, she realized the whole trip would cost around ₹5000. At first, she felt a little lost. “Where will I get that much?” she thought.

She thought, “This is a big goal, but if Rohan can do it for his game, I can do it for my trip!” so She picked up an old notebook and made a plan. She wrote:

“Trip Budget – ₹5000”

Bus tickets: ₹1000

Stay: ₹1500

Food: ₹800

Shopping & fun: ₹700

Buffer for safety: ₹1000

She had 7 months. That meant saving around ₹700 a month. It wasn’t easy, but she was focused

Her 7-Month Journey to BINGO

- Month 1: Priya cut down on extra snacks and burgers, saving a solid ₹700 from her ₹1000. A great start!

- Month 2: She repeated the saving, another ₹700. Her total was now ₹1400.

- Month 3: Friends wanted to go for a new movie. It was tempting! She joined them but was smart about her spending, only saving ₹500 that month. Still, her total was ₹1900. She even managed to convince her Mom for an extra ₹100 (don’t tell Dad!), pushing her to ₹2000!

- Month 4: More focused now, she saved ₹700 again. Total: ₹2700.

- Month 5: She needed a new T-shirt, a small reward for her efforts. She bought it but still saved ₹700. Total: ₹3400.

- Month 6: The trip was getting closer! She made a final big push, saving another ₹700. Total: ₹4100.

- Month 7 (Target Month): Her own ₹1000 income for the month, added to her ₹4100 savings, gave her ₹5100. She still needed a little extra for the trip, and with a final request to her parents who saw her hard work, she got the remaining ₹500.

BINGO! ₹5600 in hand! Enough for her trip with her friends! That extra ₹600 was a nice buffer, or as we say, a “crunch”! Priya proved that big goals are just a series of small, consistent steps.

Why the Child Rule Works for YOU (Even If You’re an Adult!)

The “Child Rule” isn’t just for kids. It’s about retraining your brain to approach money with clarity, discipline, and a dash of childlike optimism. Here’s why this mindset is your ultimate financial weapon, especially when you’re facing a crisis:

- Crystal-Clear Goals: Kids don’t save for “someday.” They save for that specific toy. As adults, we often lose this focus. The Child Rule forces you to define your “game” whether it’s an emergency fund, a down payment, or clearing a specific debt.

- Instant Gratification vs. Delayed Reward: We’re constantly bombarded with temptations (“new snack in the market”). The Child Rule helps you consciously choose a bigger, more satisfying reward over fleeting pleasures. It’s hard for a few months, but trust me, in a year you’re not broke – you’re prepared.

- The Power of the “Piggy Bank” (Dedicated Savings): Just like a child’s secure piggy bank, setting aside money into dedicated accounts for specific goals (e.g., an emergency fund, a health buffer) makes it harder to dip into.

- Small Steps, Big Results: You don’t need a huge income to start. Every rupee saved is a rupee closer to your goal. The cumulative effect is staggering over time.

- Emotional Connection: Financial planning can be dry. Your goal is your “game” – something you genuinely desire. This emotional link fuels your motivation, just like Rohan’s desire for his video game.

Applying the Child Rule to Your Adult Life: Your Levels of Financial Freedom

The beauty of the Child Rule is its scalability. Here’s how it translates to your life stage and income:

- Level 3: The ₹10,000 Reality Budget (Working Youth / Starting Career)

- Your Goal: Building a small emergency buffer (say, ₹10,000-₹15,000) or saving for a skill upgrade course.

- The Rule in Action: If you earn around ₹10,000, after covering your basics like food and travel, challenge yourself to put aside ₹1000 or ₹2000 every month. Think of those extra coffees or impulse buys as your “candy.” Just by consciously cutting down on a few, you can reach your goal surprisingly fast!

- Level 4: The ₹30,000 Responsibility Plan (Family Guy/Gal)

- Your Goal: Securing health insurance, building a robust emergency fund (₹30,000-₹50,000 minimum), or starting kids’ education savings.

- The Rule in Action: With an income around ₹30,000, once your family expenses, loan EMIs, and necessary insurance premiums are covered, identify your “candy money.” Those small, daily non-essentials add up. Even if you save ₹3000 to ₹5000 consistently each month, imagine the peace of mind of having a substantial financial cushion within a year.

- Level 5: The ₹1 Lakh Growth Plan (Senior Salaried / Business Owner)

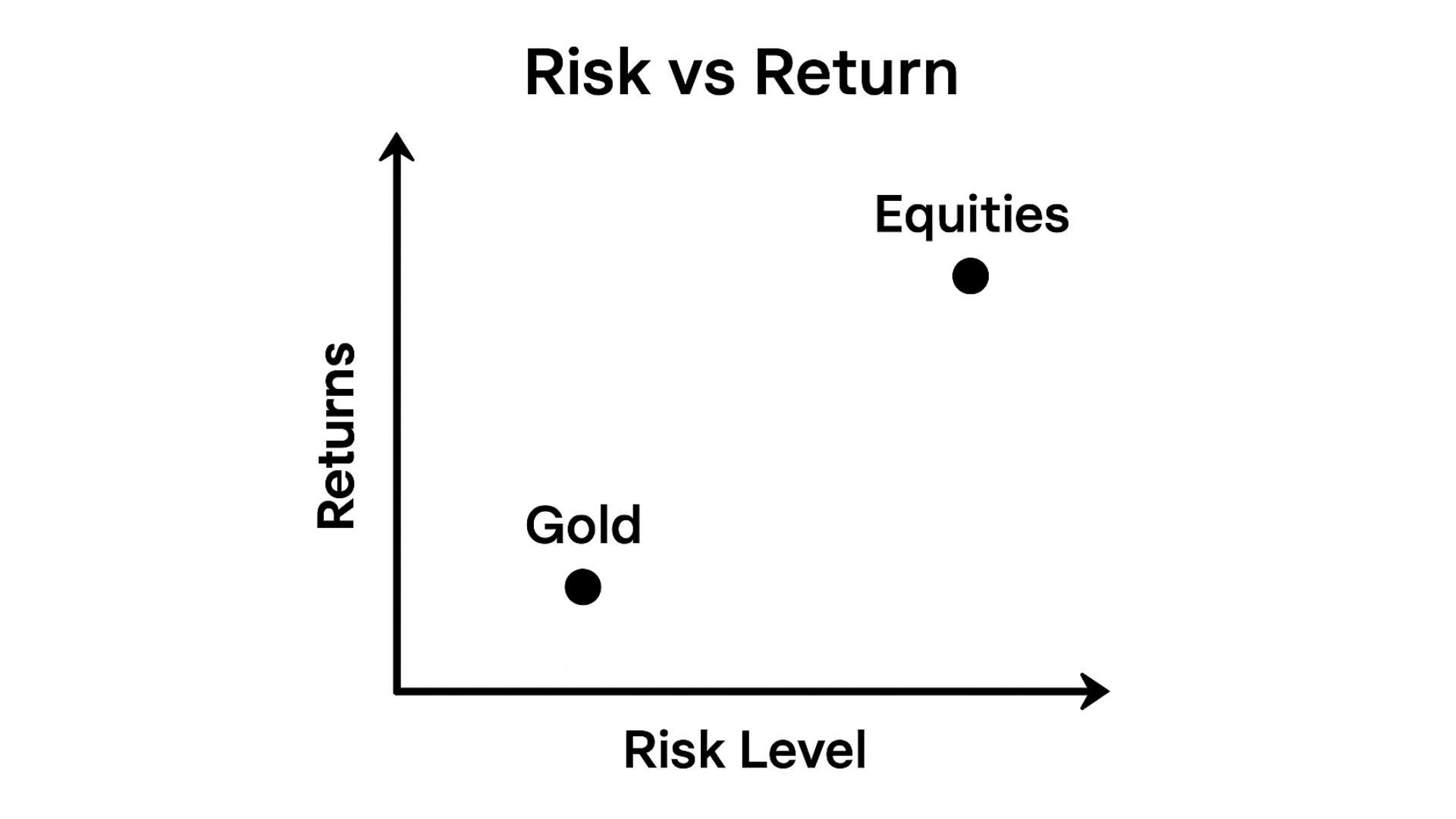

- Your Goal: Long-term investments, wealth creation, retirement planning, or major life goals like a house down payment.

- The Rule in Action: Even at this income level, the “Child Rule” is powerful. It’s about optimizing your “candy” (luxury expenses or unnecessary subscriptions) and consciously dedicating significant portions to growth. Automate your savings and investments. If you earn ₹1 Lakh, can you consciously decide to cut down ₹10,000 from discretionary spends and invest it regularly? Over time, this small “sacrifice” transforms your entire financial future.

Your Income Doesn’t Define You Your Mindset Does

No matter where you stand earning ₹10,000 or ₹1 Lakh the choice is always yours. You know your life better than anyone else. You know what your real goal is, what number matters to you, and what you’re truly saving for. Maybe it’s peace of mind, maybe it’s freedom, or maybe it’s finally being ready for the unexpected. Just remember the Child Rule: Set your goal, make a clear plan, stay consistent like a child saving for their favorite game… and one day, you’ll hit your own BINGO. That’s not just saving that’s winning.

Your “Child Rule” Action Plan: Let’s Get Started!

Ready to play the game of financial freedom? It’s easier than you think when you approach it like a friend:

- What’s Your “Game”? Think about that one big financial goal that truly excites you right now. Write it down. Maybe it’s “₹20,000 for emergencies by next year” or “Clear that nagging credit card debt in 6 months.” Make it specific!

- Know Your “Allowance”: Just like Rohan knew he had ₹100. Figure out your monthly income after taxes. Then, list your absolute must-have expenses (rent, food, bills). What’s left? That’s your starting point.

- Find Your “Candy”: Be honest with yourself, like a friend asking. Where does your money vanish without you even noticing? Is it daily snacks, unnecessary subscriptions, or too many online purchases? Pinpoint those small leaks.

- Make Your Simple Plan: Grab a notebook or a scrap of paper. Write down your main goal and how much you think you can save each month without too much stress. Then think of one or two small things you can cut this month your little “candy” to help make space for saving. That’s it. Simple and clear.

- Track with Joy (No Scary Math!): This is the fun part! At the end of each month, just mark if you hit your saving goal. A simple tick, a happy face, or a sticker can work wonders. This isn’t about complex calculations; it’s about seeing your progress visually, like filling a piggy bank.

- Your “Piggy Bank” for Adults: Consider opening a separate, simple savings account just for your “game” money. It makes it harder to accidentally spend it.

The First Few Months Feel Hard But Then It Feels Like Magic

It might feel a little challenging for the first few months, as you learn to control those cravings. But trust me, as your friend, within a year, you won’t just be saving; you’ll be building habits that lead to lasting financial independence.

So go ahead pick your goal, grab a pen, and start your game. The only thing standing between you and your BINGO is your first step..